Tip: start typing a company name to see suggestions. Press Enter or click Go to open its analysis page.

Market Performance Visuals

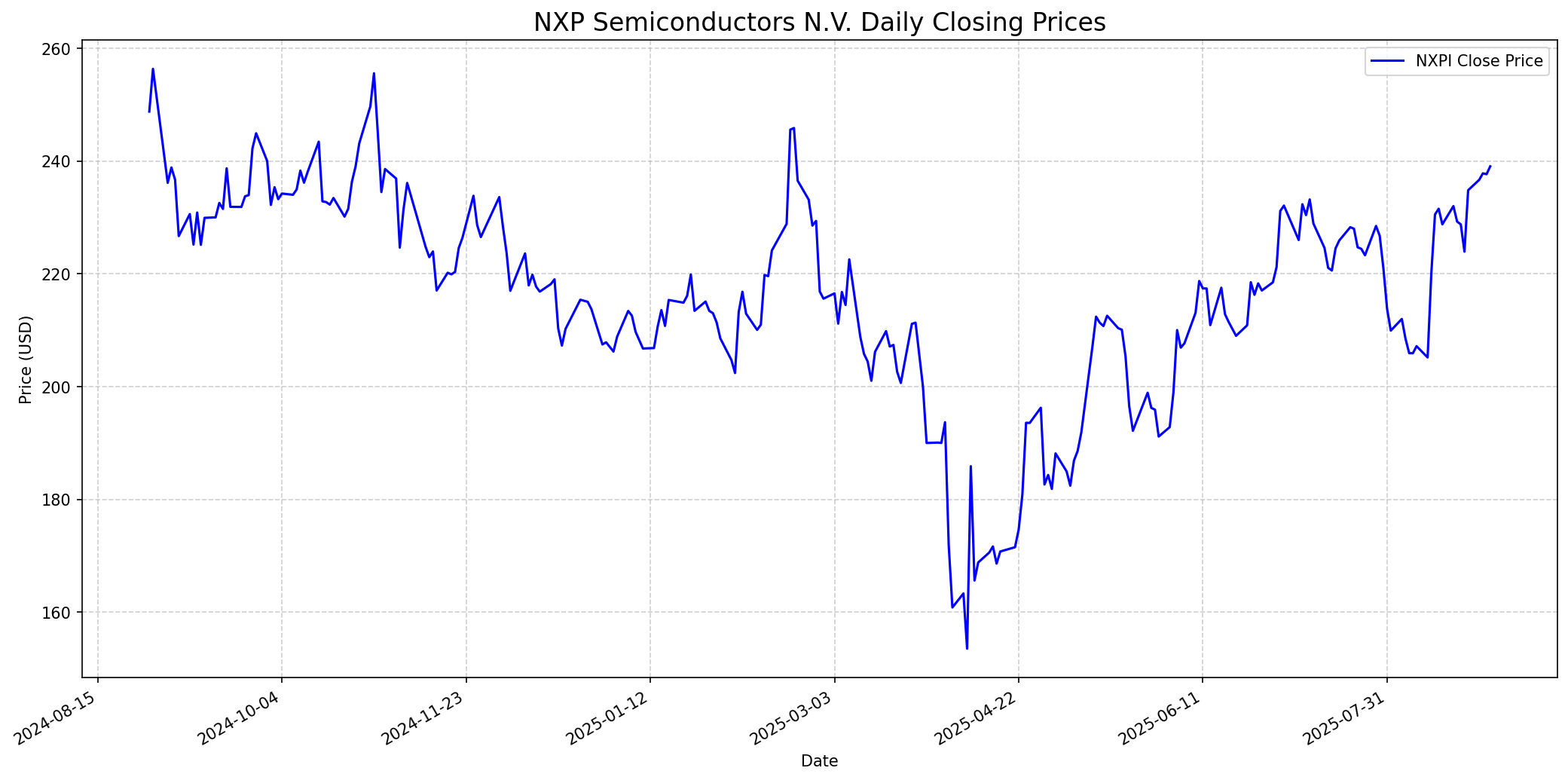

Stock Performance

Daily closing price of NXPI.

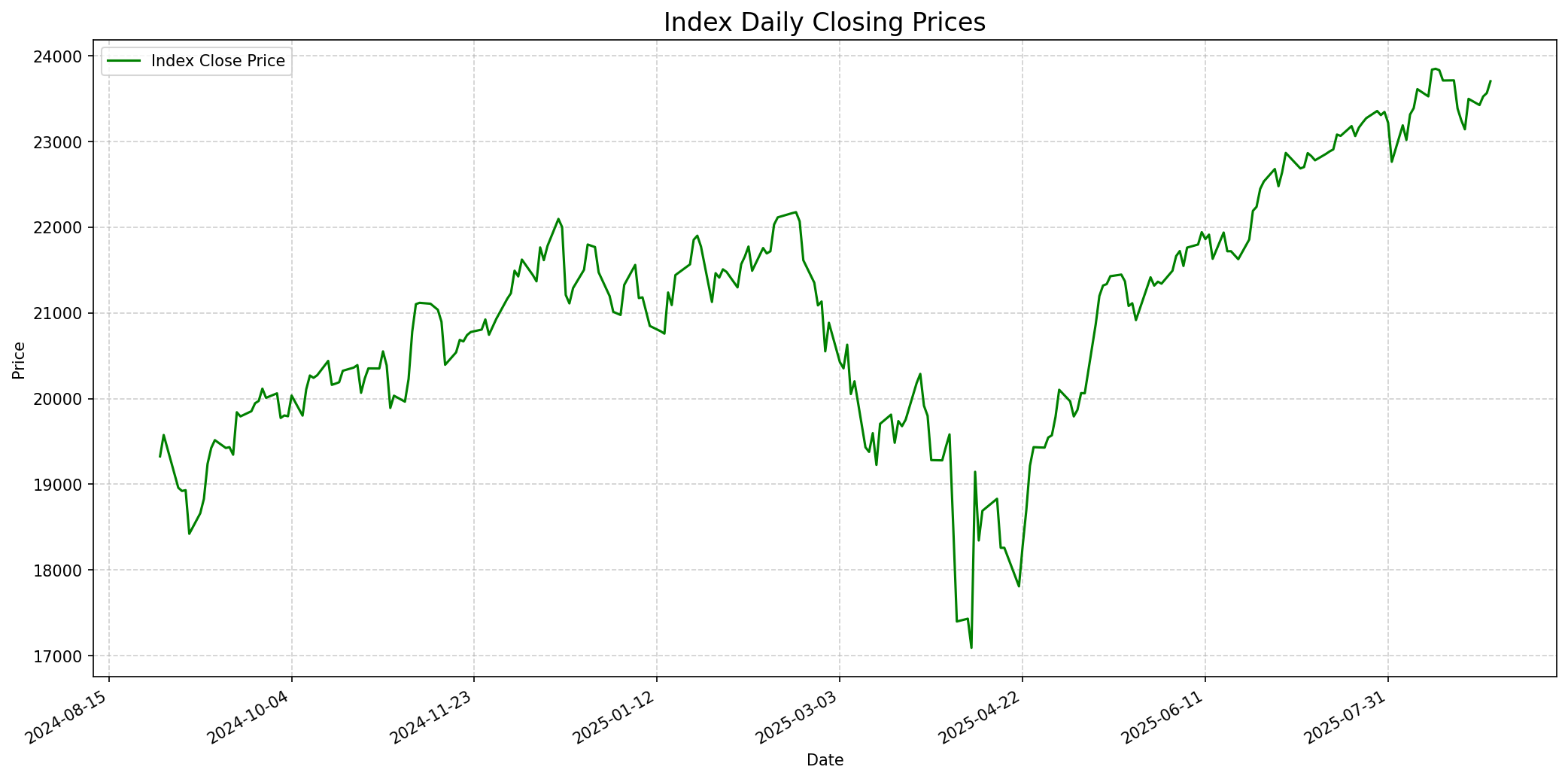

Relevant Index Performance

Performance of the relevant market index.

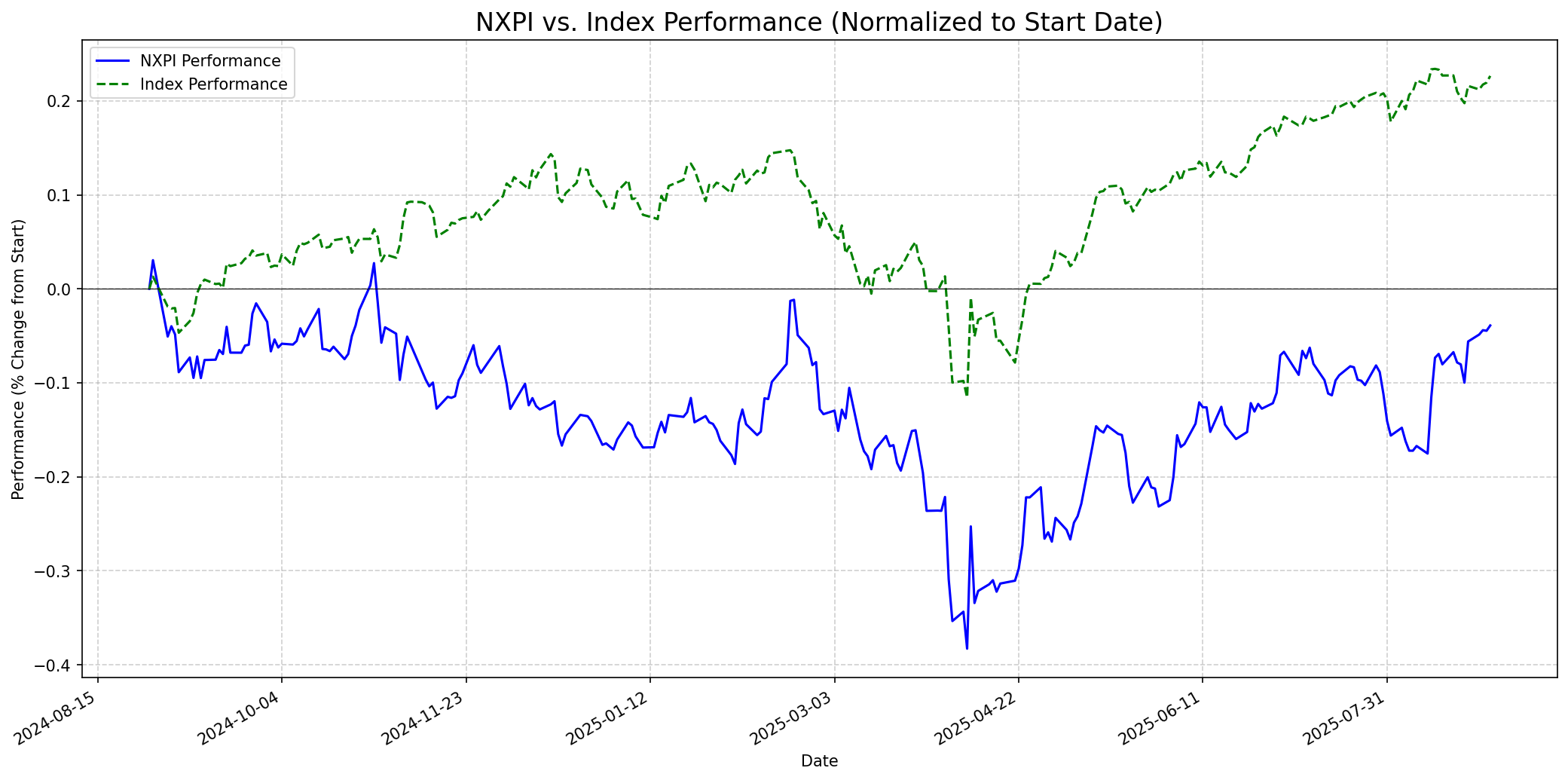

Stock Relative to Index

NXPI's performance compared to its index.

Social Media Sentiment

Reddit: Bearish

Recent discussions on WallstreetBets indicate a bearish sentiment for NXPI, with 33% positive and 67% negative comments in the last 24 hours. While some older posts show interest in NXPI as a play on the EV market, more recent threads reflect disappointment over forecast misses and the ongoing chip glut impacting automotive and industrial sectors. Overall, there's a prevailing sense of caution and some negativity regarding NXP's near-term performance.

Twitter/X: Mixed

Sentiment on Twitter/X appears mixed, leaning slightly bearish, as indicated by mentions of 'bearish technical signals' and 'weak market sentiment' from some AI-driven analyses. There's also a noted increase in short interest for NXPI, which can suggest growing bearishness, although NXP has less short interest compared to its peer group average. No specific key influencers or trending hashtags were explicitly identified in the search results, but the general tone reflects a watchful approach due to market conditions affecting the semiconductor sector.

Fundamentals

NXP Semiconductors N.V. (NXPI) is a leading semiconductor company based in the Netherlands, specializing in high-performance mixed-signal analog-digital and standard product solutions. Its primary markets include automotive, industrial & IoT, mobile, and communications infrastructure. The company reported revenue of $12.61 billion in 2024, a 5% decrease year-on-year, with diluted EPS decreasing to $9.73 from $10.70 in 2023. The automotive sector remains its largest revenue contributor. NXP maintains a strong capital structure, evidenced by its ongoing capital return program and consistent dividend payments since 2018. The company's profitability metrics include a GAAP gross margin of 56.4% and a net profit margin of 20% for the full year 2024. While strong in innovation and market position, NXP faces challenges from market volatility, competition in the semiconductor space, and potential regulatory headwinds. Analysts generally view NXPI with a 'Strong Buy' or 'Moderate Buy' consensus for its long-term potential, particularly in the growing automotive and industrial IoT segments, despite recent declines in some financial metrics.

Performance Analysis (Last Year)

Performance: Underperformed

Over the last 365 days, NXP Semiconductors' stock price decreased by approximately 3.90% (from $248.78 to $239.07), while the broader index surged by about 22.65% (from $19325.45 to $23703.45). This indicates a significant underperformance by NXPI relative to the market. Several factors contributed to this: * **Q3 2025 Forecast Disappointment:** In July 2025, NXP's third-quarter forecast was less optimistic than some investors had anticipated, leading to a stock decline. The company's revenue also fell 6% in Q2 2025, and the Q3 forecast suggested a further 3% decline year-over-year. * **Chip Glut and Weaker Demand:** NXP has been contending with an oversupply of chips, particularly those used in electric vehicles and manufacturing operations. Weaker demand in the automotive and industrial segments, which are major revenue drivers for NXP, significantly impacted sales. * **Tariff Risks and Geopolitical Tensions:** The ongoing tariff campaigns and geopolitical tensions have disrupted global supply chains and created uncertainty regarding customer orders, further weighing on NXP's performance. * **Broader Semiconductor Industry Trends:** While the overall semiconductor industry experienced robust growth in 2024 and is projected for continued expansion in 2025, primarily driven by demand for AI and high-performance computing, NXP's specific market focus might have limited its immediate capture of this AI-driven boom compared to other players. * **Specific Stock Price Decrease Event:** There was a notable stock price decrease of over 10% on April 11, 2025.

Future Outlook

One Week

Price Target: $242.0

Performance vs Index: In-line

For the upcoming week, the outlook for NXPI is cautiously in-line with potential for slight positive movement. Technical analysis suggests buy signals from short and long-term moving averages, and a short-term rising trend. However, the stock is also noted as overbought on RSI14, indicating potential for a near-term correction. Given the recent closing price of $237.67, a small upward movement is anticipated, but significant gains are unlikely due to existing volatility and overbought conditions. A price target of around $242.00 reflects this cautious optimism within expected daily trading ranges. [30]

One Month

Price Target: $255.0

Performance vs Index: Outperform

Over the next month, NXPI is projected to outperform, supported by continued analyst optimism despite recent challenges. Several analysts have set price targets for the near term that indicate an upside. The stock is expected to continue its rising trend in the short term, with forecasts suggesting a potential rise. The recent dividend announcement should also provide some support and investor confidence. A target of $255.00 represents a reasonable upside considering the current average analyst sentiment and the projected short-term dynamics. [1, 4, 12, 30]

One Year

Price Target: $260.0

Performance vs Index: Outperform

The one-year outlook for NXP Semiconductors is positive, with expectations of outperformance. The consensus analyst rating is 'Strong Buy' or 'Moderate Buy', with an average 12-month price target around $250-$265. The company's strategic acquisitions, such as TTTech Auto, strengthen its position in the growing automotive sector, particularly in software-defined vehicles. The broader semiconductor industry is projected for double-digit growth in 2025, driven by AI, IoT, and advanced packaging, areas where NXP has significant exposure. While NXP faced headwinds in 2024 and early 2025 related to a chip glut in certain segments and geopolitical tensions, its focus on key growth markets and robust capital return program underpin a favorable long-term view. A price target of $260.00 reflects the general analyst consensus and the expected recovery and growth in its core markets. [1, 4, 6, 7, 12, 14, 15, 16, 19, 23, 26]

Latest News

NXP Semiconductors N.V. Announces Interim Dividend of $1.014 per Share for Q3 2025

NXP Semiconductors announced on August 28, 2025, an interim dividend of $1.014 per ordinary share for the third quarter of 2025. This reflects the company's strong capital structure and confidence in its long-term growth and cash flow. The dividend is payable on October 8, 2025. This positive news signals financial stability and a commitment to shareholder returns, which can support stock price stability and investor confidence. [2, 8, 14, 17]

NXP Semiconductors Reports Second Quarter 2025 Results

On July 21, 2025, NXP Semiconductors reported its Q2 2025 financial results. The company's revenue fell 6% to $2.93 billion, in line with analyst estimates, and beat EPS estimates at $2.72 per share against $2.68 estimated. However, its Q3 2025 revenue forecast of $3.05 billion to $3.25 billion was less bullish than some investors anticipated, causing the stock to slide about 5% in extended trading. This indicates that while the company met Q2 expectations, its future guidance reflects ongoing challenges in certain segments. [14, 31, 38]

NXP Completes Acquisition of TTTech Auto

NXP completed the acquisition of TTTech Auto on June 17, 2025, aimed at accelerating the transformation to software-defined vehicles (SDVs). This strategic move strengthens NXP's position in the automotive semiconductor market, a key segment for the company. The acquisition is expected to bolster NXP's offerings for advanced safety-critical systems and middleware, potentially enhancing its long-term growth prospects in the evolving automotive industry. [14, 19]

Rumors

NXP stock price decrease: Speculation on underlying causes beyond official reports

While not a widespread rumor, some discussions on Reddit following NXP's stock price decrease of over 10% on April 11, 2025, and disappointing Q3 2025 forecast, might have involved speculation about deeper underlying issues beyond the officially cited chip glut and tariff risks. This could include unconfirmed concerns about demand sustainability or competitive pressures that are not fully disclosed, potentially creating uncertainty among investors. [8, 31]

Emerging Indian AI Startups as Long-Term Competition Risk

A recent analysis highlights that emerging Indian AI startups, led by ex-Intel/AMD executives, pose long-term competition risks for established chip companies like NXP. While not a direct rumor, the mention of such competitive threats, especially in the rapidly evolving AI sector where NXP might be perceived as under-indexed compared to some peers, could foster speculation about NXP's ability to maintain its market share and growth trajectory in the long run. [9]

Overview

Snapshot

Short-term Outlook

1-Year Outlook

The one-year outlook for NXP Semiconductors is positive, with expectations of outperformance. The consensus analyst rating is 'Strong Buy' or 'Moderate Buy', with an average 12-month price target around $250-$265. The company's strategic acquisitions, such as TTTech Auto, strengthen its position in the growing automotive sector, particularly in software-defined vehicles. The broader semiconductor industry is projected for double-digit growth in 2025, driven by AI, IoT, and advanced packaging, areas where NXP has significant exposure. While NXP faced headwinds in 2024 and early 2025 related to a chip glut in certain segments and geopolitical tensions, its focus on key growth markets and robust capital return program underpin a favorable long-term view. A price target of $260.00 reflects the general analyst consensus and the expected recovery and growth in its core markets. [1, 4, 6, 7, 12, 14, 15, 16, 19, 23, 26]