Tip: start typing a company name to see suggestions. Press Enter or click Go to open its analysis page.

Market Performance Visuals

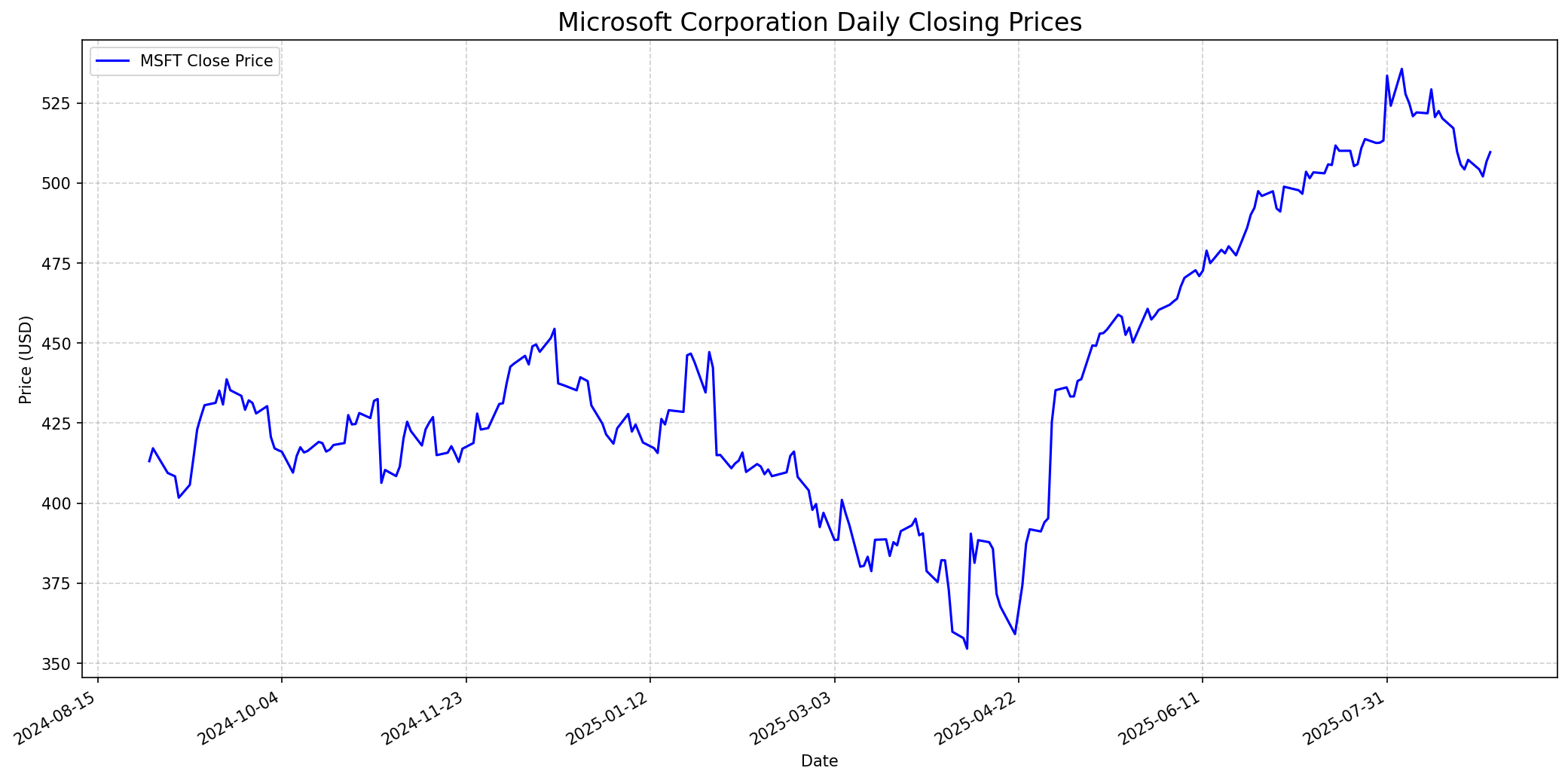

Stock Performance

Daily closing price of MSFT.

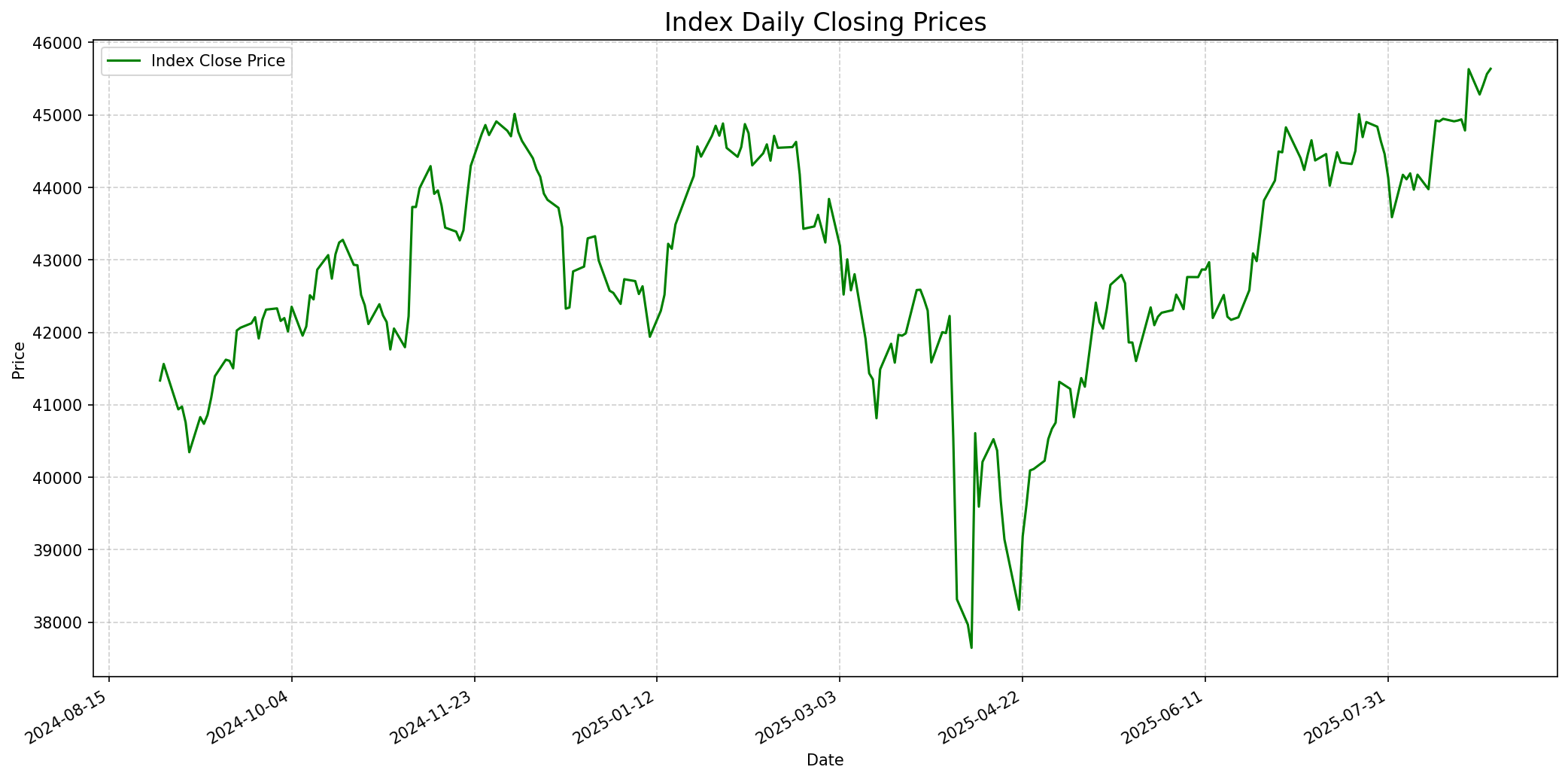

Relevant Index Performance

Performance of the relevant market index.

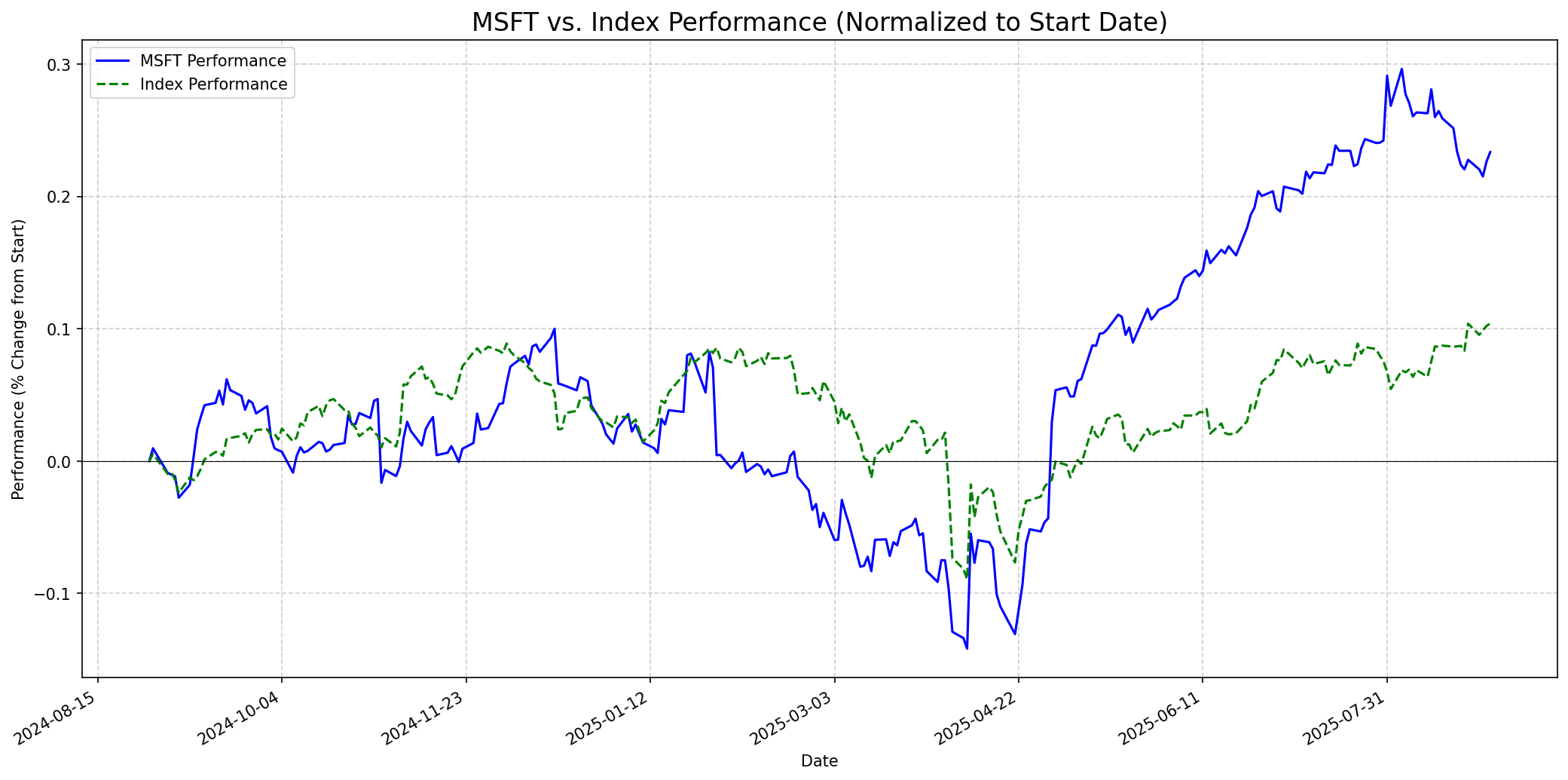

Stock Relative to Index

MSFT's performance compared to its index.

Social Media Sentiment

Reddit: Mixed/Bullish

Recent discussions on Reddit regarding Microsoft show a mixed to bullish sentiment. AltIndex reported a neutral sentiment score of 0.60, indicating balanced opinions. However, other platforms tracking Reddit mentions, particularly on WallstreetBets, noted 77% positive comments over the last 24 hours. Key themes revolve around Microsoft's strong growth potential, particularly in cloud services and AI, with some users highlighting its consistent performance. There are also discussions on valuation, with some suggesting current prices are high but justified by growth, while others consider the P/E ratio. Overall, the community generally acknowledges Microsoft's strong market position and future prospects, despite some cautious notes on valuation.

Twitter/X: Bullish

Sentiment on Twitter/X regarding Microsoft (MSFT) appears predominantly bullish. Recent posts frequently highlight positive news such as outstanding earnings reports, significant AI advancements (like GPT-5 integration and Copilot adoption), and strategic partnerships with major entities like the Premier League and NFL. Analyst upgrades and reiterations of 'Buy' ratings are also widely shared and contribute to positive sentiment. Key influencers and financial news accounts emphasize Microsoft's leadership in AI and cloud computing as major growth drivers. There is minimal negative sentiment reported, with the focus largely on the company's strong performance and future potential.

Fundamentals

Microsoft Corporation (MSFT) demonstrates robust fundamental strength, underscored by consistent double-digit revenue and earnings growth. For Q4 FY2025, the company reported a revenue increase of 18% to $76.4 billion and a net income climb of 24% to $27.2 billion, with diluted EPS at $3.65. Key growth drivers include its Intelligent Cloud segment, with Azure revenue growing 39%, and the broader Microsoft Cloud revenue reaching $46.7 billion, up 27%. The Productivity and Personal Computing segments also showed healthy growth. Analysts forecast continued strong performance, with revenue expected to reach $328.86 billion this year (up 16.73%) and $376.04 billion next year (up 14.35%). EPS is projected to rise to $15.81 this year (up 15.95%) and $18.51 next year (up 17.04%). Microsoft maintains a strong balance sheet with a current ratio of 1.35 and a low debt-to-equity ratio of 0.18, indicating solid liquidity and manageable leverage. Its impressive operating margin of 45.62% and net margin of 36.15% highlight efficient operations and strong profitability. The company's focus on AI integration across its product portfolio, strategic partnerships (e.g., Premier League, NFL, OpenAI), and expanding cloud infrastructure positions it well for sustained long-term growth.

Performance Analysis (Last Year)

Performance: Outperformed

Over the last 365 days, Microsoft's stock price increased by approximately 23.37% (from $413.12 to $509.64). In contrast, the provided index (Dow Jones Industrial Average based on the scale of provided numbers) increased by approximately 10.41% (from $41335.05 to $45636.90). Therefore, Microsoft significantly outperformed the index. This strong performance can be attributed to several key factors. The company consistently delivered outstanding earnings reports, frequently beating analyst estimates for both revenue and EPS. A major catalyst has been Microsoft's aggressive expansion and innovation in Artificial Intelligence, particularly with its Azure AI platform, Copilot, and the integration of GPT-5, which have been widely adopted and driven significant growth in its Intelligent Cloud segment. Strategic partnerships, such as those with the Premier League and NFL, further extended Microsoft's influence and demonstrated the broad applicability of its AI and cloud technologies. While there were minor headwinds like reported employee layoffs and internal protests, these did not deter the overall positive market perception, which was reinforced by strong institutional support and a 'tariff-neutral' business model that potentially insulated it from some macroeconomic trade tensions affecting other tech giants. Overall, robust financial health and sustained innovation in high-growth areas fueled Microsoft's superior performance.

Future Outlook

One Week

Price Target: $515.0

Performance vs Index: Outperform

Given the recent strong earnings report, ongoing positive news flow regarding AI and partnerships, and a generally bullish analyst consensus, MSFT is likely to maintain its upward momentum in the short term. The stock has been trading near its 52-week highs, and while minor fluctuations are possible, the strong underlying catalysts should lead to outperformance relative to the broader market over the next week. [3, 17, 20]

One Month

Price Target: $530.0

Performance vs Index: Outperform

Over the next month, the strong fundamental tailwinds, including continued adoption of AI solutions like Copilot and growth in Azure, are expected to sustain Microsoft's performance. The overwhelmingly positive analyst ratings and price targets, with several recent upgrades, suggest continued investor confidence. Any minor market pullbacks might be seen as buying opportunities, reinforcing an outperform stance. [1, 4, 5, 10, 17, 19, 30]

One Year

Price Target: $617.0

Performance vs Index: Outperform

The one-year outlook for Microsoft remains highly positive, with an average analyst price target around $612-$624, representing a significant upside from the current price. [1, 2, 4, 5, 6, 10, 11, 17, 22] Microsoft's long-term strategy centered on cloud computing (Azure's market share), artificial intelligence dominance, and a diversified product ecosystem (Office 365, gaming, LinkedIn) provides a strong foundation. The company's financial strength, consistent innovation, and ability to monetize new technologies are expected to drive sustained earnings and revenue growth, allowing it to continue outperforming the broader market. [30, 35]

Latest News

Microsoft Reports Outstanding Q4 FY2025 Results Driven by Cloud and AI Growth

Microsoft reported Q4 FY2025 revenue surging 18% to $76.4 billion and net income climbing 24% to $27.2 billion, with diluted EPS reaching $3.65, up 24% year-over-year. The Intelligent Cloud segment, led by Azure's 39% revenue growth, was a primary driver. These strong results reinforce investor confidence in Microsoft's ongoing growth trajectory, particularly in its cloud and AI initiatives. [3]

Premier League and Microsoft Announce Five-Year AI Partnership

Microsoft and the Premier League have partnered for five years to enhance fan engagement for 1.8 billion supporters globally. Microsoft will serve as the official cloud and AI partner, introducing the Premier League Companion powered by Copilot. This collaboration highlights Microsoft's expanding reach and application of its AI technology in diverse sectors, potentially boosting its brand and Azure adoption. [3]

Microsoft Expands NFL Partnership, Integrating Copilot to the Sidelines

Microsoft and the NFL have expanded their strategic partnership to integrate AI technology, specifically Surface Copilot+ tools, across the league's operations for all 32 teams. This move showcases Microsoft's commitment to advancing AI solutions and securing high-profile partnerships, further embedding its technology into daily operations of major organizations. [3, 20]

Microsoft Unveils AI-Powered Financial Solutions with Hebbia Integration

Microsoft has integrated GPT-5 into Hebbia's platform via Microsoft Azure AI Foundry, signaling a strong commitment to advancing AI technologies for financial solutions. This initiative could broaden Microsoft's revenue streams and solidify its position as a leader in enterprise AI applications. [8]

UBS Reaffirms 'Buy' Rating for Microsoft with $650 Price Target

UBS has reaffirmed its 'Buy' rating for Microsoft with a price target of $650, following Microsoft's announcement of its Quantum Safe Program Strategy. This analyst endorsement reflects continued confidence in Microsoft's strategic direction and future growth prospects across various technological frontiers. [15]

Rumors

Microsoft Fires Employees Over Office Sit-in Protest

Microsoft recently fired two employees for breaking into President Brad Smith's office to stage a sit-in protest. While not a financial rumor, such internal events can generate social media discussion and, if prolonged or significant, could temporarily impact public perception or employee morale. [9]

Overview

Snapshot

Short-term Outlook

1-Year Outlook

The one-year outlook for Microsoft remains highly positive, with an average analyst price target around $612-$624, representing a significant upside from the current price. [1, 2, 4, 5, 6, 10, 11, 17, 22] Microsoft's long-term strategy centered on cloud computing (Azure's market share), artificial intelligence dominance, and a diversified product ecosystem (Office 365, gaming, LinkedIn) provides a strong foundation. The company's financial strength, consistent innovation, and ability to monetize new technologies are expected to drive sustained earnings and revenue growth, allowing it to continue outperforming the broader market. [30, 35]