Tip: start typing a company name to see suggestions. Press Enter or click Go to open its analysis page.

Market Performance Visuals

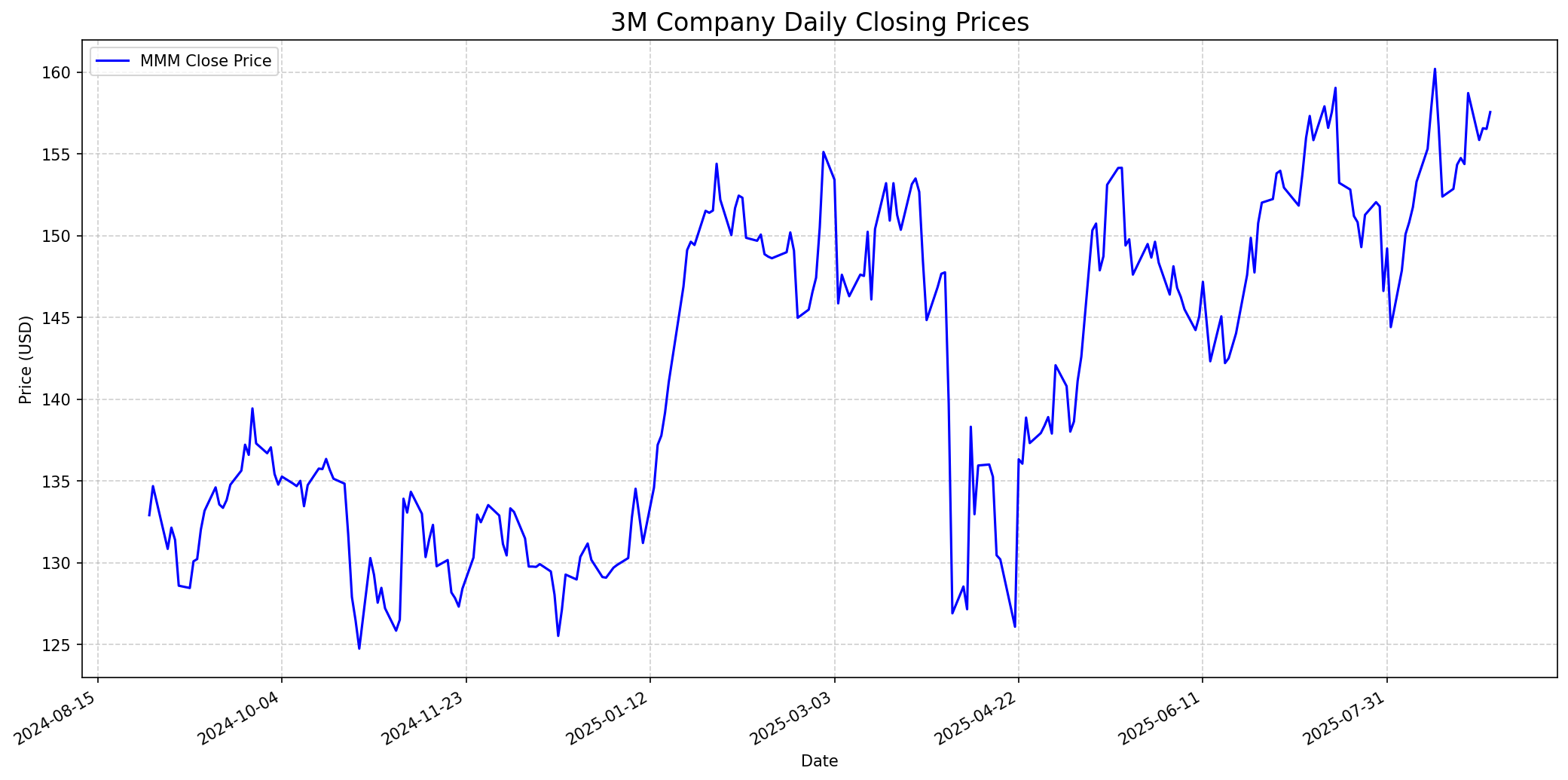

Stock Performance

Daily closing price of MMM.

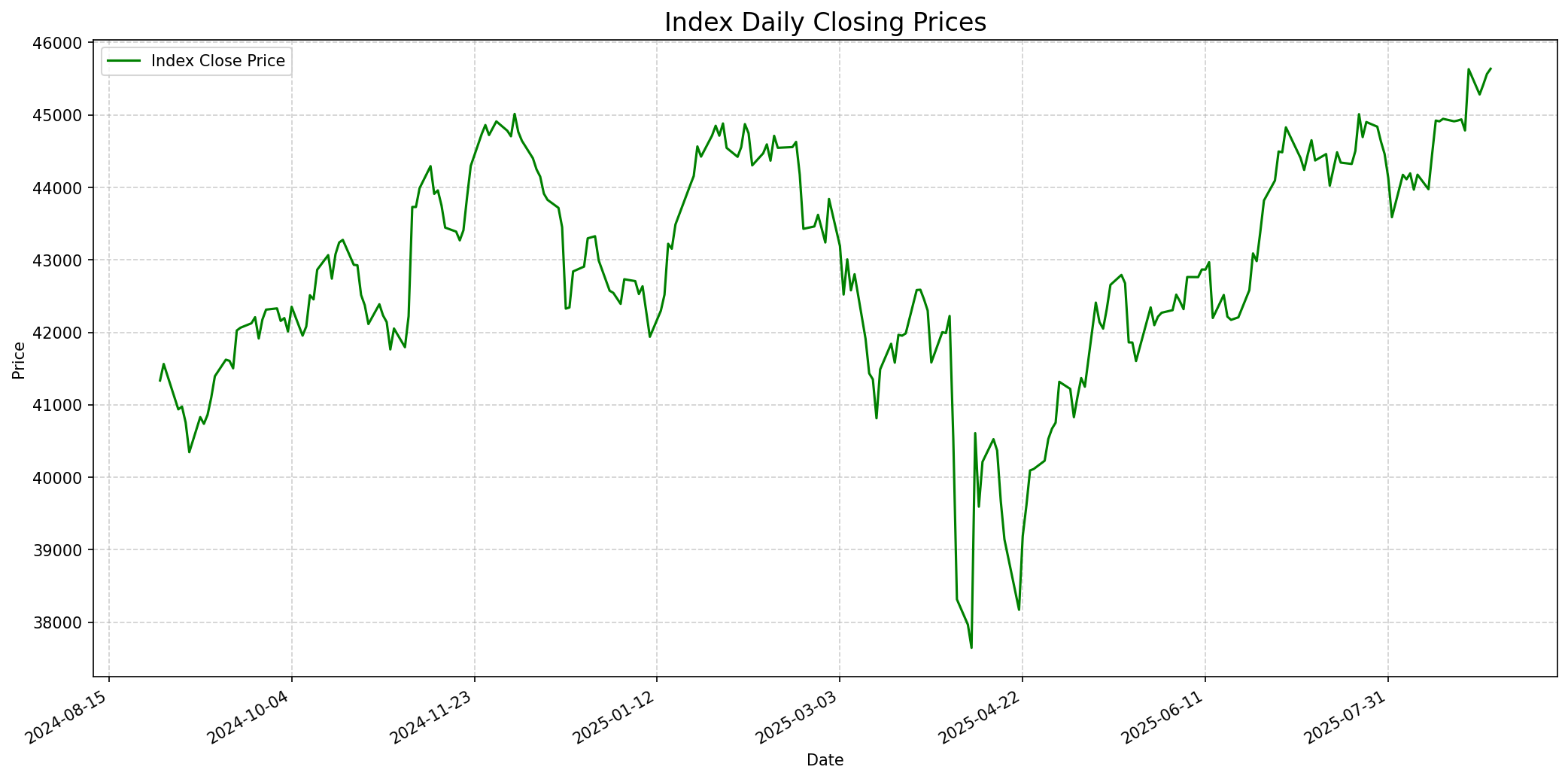

Relevant Index Performance

Performance of the relevant market index.

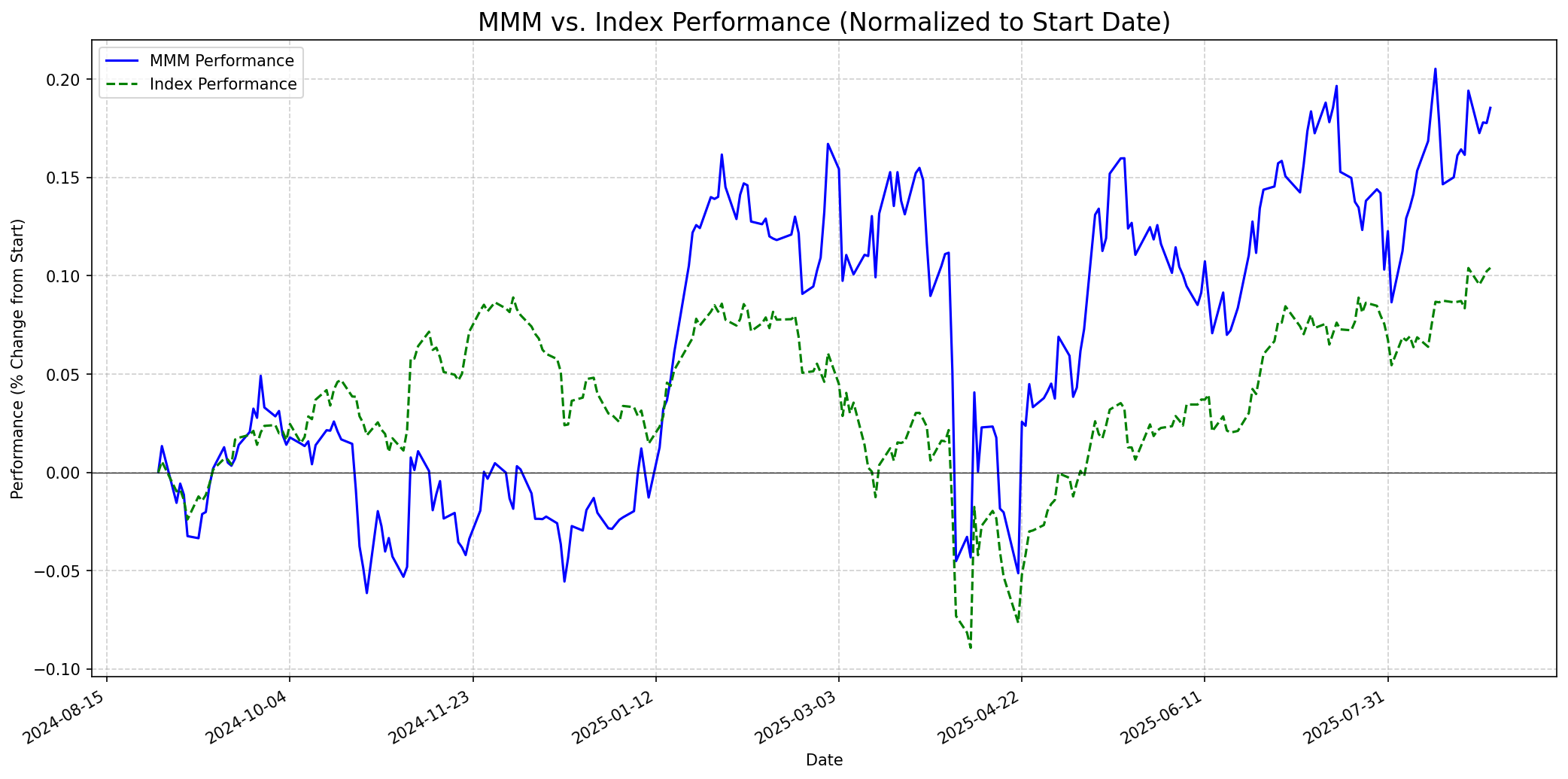

Stock Relative to Index

MMM's performance compared to its index.

Social Media Sentiment

Reddit: Slightly Bearish

Past Reddit discussions on 3M (MMM) have frequently highlighted concerns regarding the company's significant legal liabilities, particularly the earplug and PFAS lawsuits, and historical underperformance, which fostered a generally negative sentiment. While recent settlements aim to resolve these issues, the lingering effects and ongoing payment schedules suggest that some cautious sentiment may persist. Recent positive earnings news might mitigate some of this, but deep-seated concerns could still influence discussions.

Twitter/X: Mixed

Sentiment on Twitter/X regarding 3M (MMM) appears mixed. Positive news, such as stronger-than-expected Q2 2025 earnings, increased full-year guidance, and dividend declarations, tends to generate positive discussion. However, mentions of ongoing tariff worries and the Solventum secondary offering introduce elements of caution. The overall sentiment across social media has shown a positive shift over the last three months, though short-term sentiment remains stable, suggesting a balance between positive operational developments and external economic and financial considerations.

Fundamentals

3M Company (MMM) is a diversified global technology firm with operations across Safety and Industrial, Transportation and Electronics, Health Care (following the Solventum spin-off), and Consumer segments. The company reported a slight revenue decrease in 2024 to $24.575 billion, but organic sales demonstrated growth, with 1.2% year-over-year in 2024 and 1.5% in Q2 2025. 3M anticipates full-year 2025 adjusted organic sales to increase by up to 3% and adjusted earnings per share (EPS) to be between $7.75 and $8.00. Financially, 3M exhibits adequate short-term liquidity with a current ratio of 1.41 and a quick ratio of 1.08 as of Q4 2024. While the debt-to-equity ratio is high at 303.4%, interest payments are well covered by EBIT at 6.9x. The company's adjusted operating margin improved to 24.5% in Q2 2025, reflecting effective cost management. 3M is committed to returning at least $10 billion in cash to shareholders over the medium term, demonstrating a focus on shareholder value.

Performance Analysis (Last Year)

Performance: Outperformed

Over the last 365 days, 3M Company (MMM) significantly outperformed its index. 3M's stock price increased by approximately 18.55% (from $132.91 to $157.56), while the provided index saw a rise of approximately 10.41% (from $41335.05 to $45636.90). This outperformance was driven by several key factors. A major catalyst was the resolution of significant legal overhangs, including the $6.01 billion earplug settlement and the $10.3 billion PFAS settlement. These settlements, finalized in late 2023 and early 2024, significantly reduced uncertainty and removed a substantial burden that had weighed on the stock for years. The spin-off of its healthcare business, Solventum, in April 2024, further streamlined 3M’s portfolio, allowing for a more focused operational strategy. Furthermore, strong Q1 and Q2 2025 earnings reports, which consistently beat analyst expectations and led to raised full-year guidance, boosted investor confidence. The introduction of a new CEO, William Brown, and his articulated multi-year improvement plan focusing on reinvigorating growth, driving operational excellence, and disciplined capital deployment, has also been viewed positively by the market, signaling a renewed strategic direction.

Future Outlook

One Week

Price Target: $158.5

Performance vs Index: In-line

In the immediate one-week term, 3M's stock is likely to trade in-line with the broader market. While the company recently announced a dividend, its ex-dividend date has passed (August 25th), which might remove a minor short-term buying incentive. Current technical indicators suggest buy signals from moving averages, but short-term price movements can be subject to broader market fluctuations and minor profit-taking after recent gains. [18, 27, 39]

One Month

Price Target: $162.0

Performance vs Index: Outperform

Over the next month, 3M is expected to outperform its index. This outlook is primarily supported by the positive momentum from the stronger-than-anticipated Q2 2025 earnings report and the subsequent increase in full-year guidance. The market continues to absorb the implications of reduced legal uncertainties following the major settlements, which should foster a more positive investment environment. The company’s strategic initiatives for operational efficiency and growth are likely to provide continued tailwinds. [5, 7, 20, 31, 38]

One Year

Price Target: $168.0

Performance vs Index: Outperform

For the one-year outlook, 3M is projected to outperform the index. This expectation is based on the significant reduction in legal overhangs that previously suppressed the stock, allowing management to fully concentrate on core business growth and strategic objectives under the new CEO, William Brown. The company aims for organic sales growth above macro levels and high-single digit annual EPS growth by 2027. [7, 13, 37, 38] Furthermore, consistent shareholder returns through dividends and planned share repurchases, alongside ongoing operational improvements and product innovation, are expected to drive long-term value. Potential risks include global economic volatility and tariff impacts. [5, 13]

Latest News

3M Reports Second-Quarter 2025 Results, Increases Full-Year EPS Guidance

3M reported strong second-quarter 2025 results on July 18, 2025, with adjusted earnings per share (EPS) of $2.16, beating analysts' expectations by 7.46%. The company also increased its full-year EPS guidance, indicating positive operational momentum. [5, 12, 20, 28, 34]

3M Board Declares Quarterly Dividend for the Third Quarter of 2025

On August 15, 2025, the 3M Board of Directors declared a quarterly dividend of $0.73 per share, payable on September 12, 2025, to shareholders of record on August 25, 2025. This move reinforces the company's commitment to returning cash to shareholders. [12, 18, 20, 27]

3M Provides Medium-Term Financial Outlook at 2025 Investor Day

During its Investor Day on February 26, 2025, 3M outlined its medium-term financial outlook, reiterating 2025 guidance and projecting organic sales growth to outperform macro trends, operating margins of approximately 25% by 2027, and high-single digit EPS growth annually. This strategic clarity aims to drive sustainable value creation. [7, 13, 17]

3M Earplug Lawsuit Settlement Progresses with Over 99% Participation

By March 26, 2024, the $6.01 billion settlement to compensate service members for hearing loss from defective earplugs achieved over 99% participation, finalizing the agreement. Payments commenced in early 2024 and are ongoing through 2029, significantly reducing a major legal overhang on the company. [10, 11, 23, 24]

3M PFAS Drinking Water Settlement Receives Final Court Approval

On April 1, 2024, 3M announced final court approval for its settlement agreement with U.S. public water suppliers regarding PFAS contamination in drinking water. The agreement involves a pre-tax present value commitment of up to $10.3 billion payable over 13 years, with payments scheduled to begin in Q3 2024. [22]

Rumors

No recent rumors found.

Overview

Snapshot

Short-term Outlook

1-Year Outlook

For the one-year outlook, 3M is projected to outperform the index. This expectation is based on the significant reduction in legal overhangs that previously suppressed the stock, allowing management to fully concentrate on core business growth and strategic objectives under the new CEO, William Brown. The company aims for organic sales growth above macro levels and high-single digit annual EPS growth by 2027. [7, 13, 37, 38] Furthermore, consistent shareholder returns through dividends and planned share repurchases, alongside ongoing operational improvements and product innovation, are expected to drive long-term value. Potential risks include global economic volatility and tariff impacts. [5, 13]