Tip: start typing a company name to see suggestions. Press Enter or click Go to open its analysis page.

Market Performance Visuals

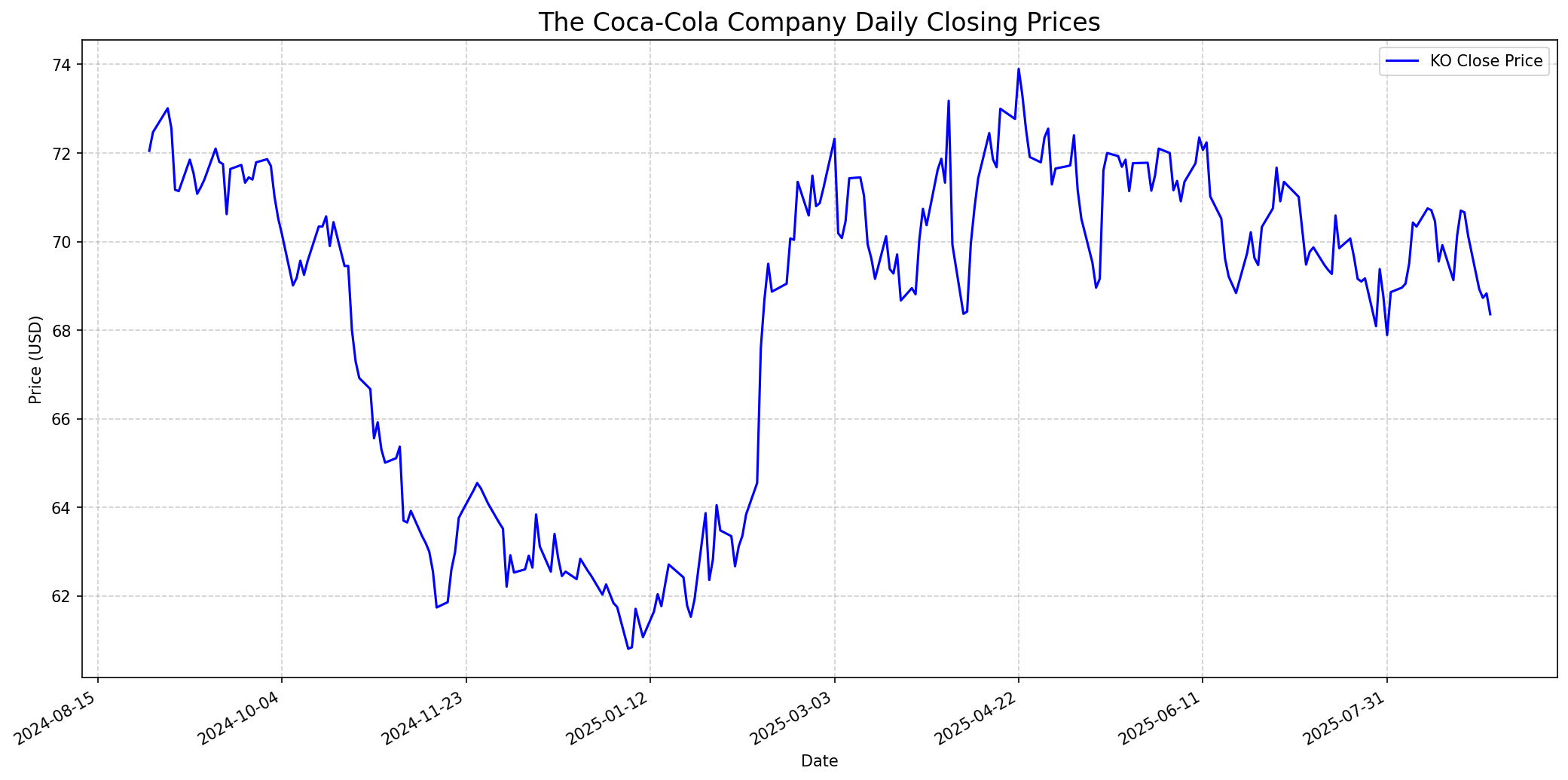

Stock Performance

Daily closing price of KO.

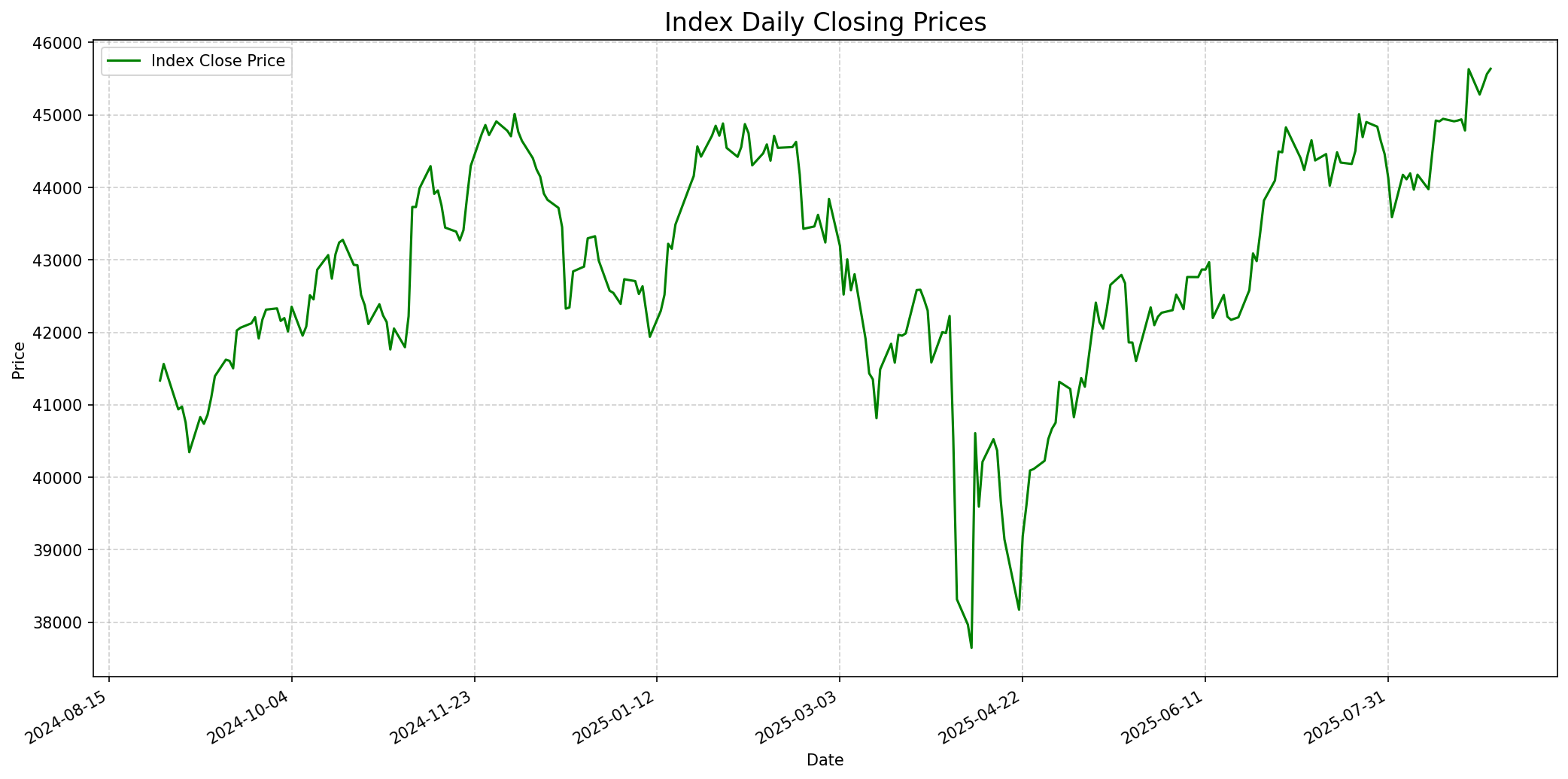

Relevant Index Performance

Performance of the relevant market index.

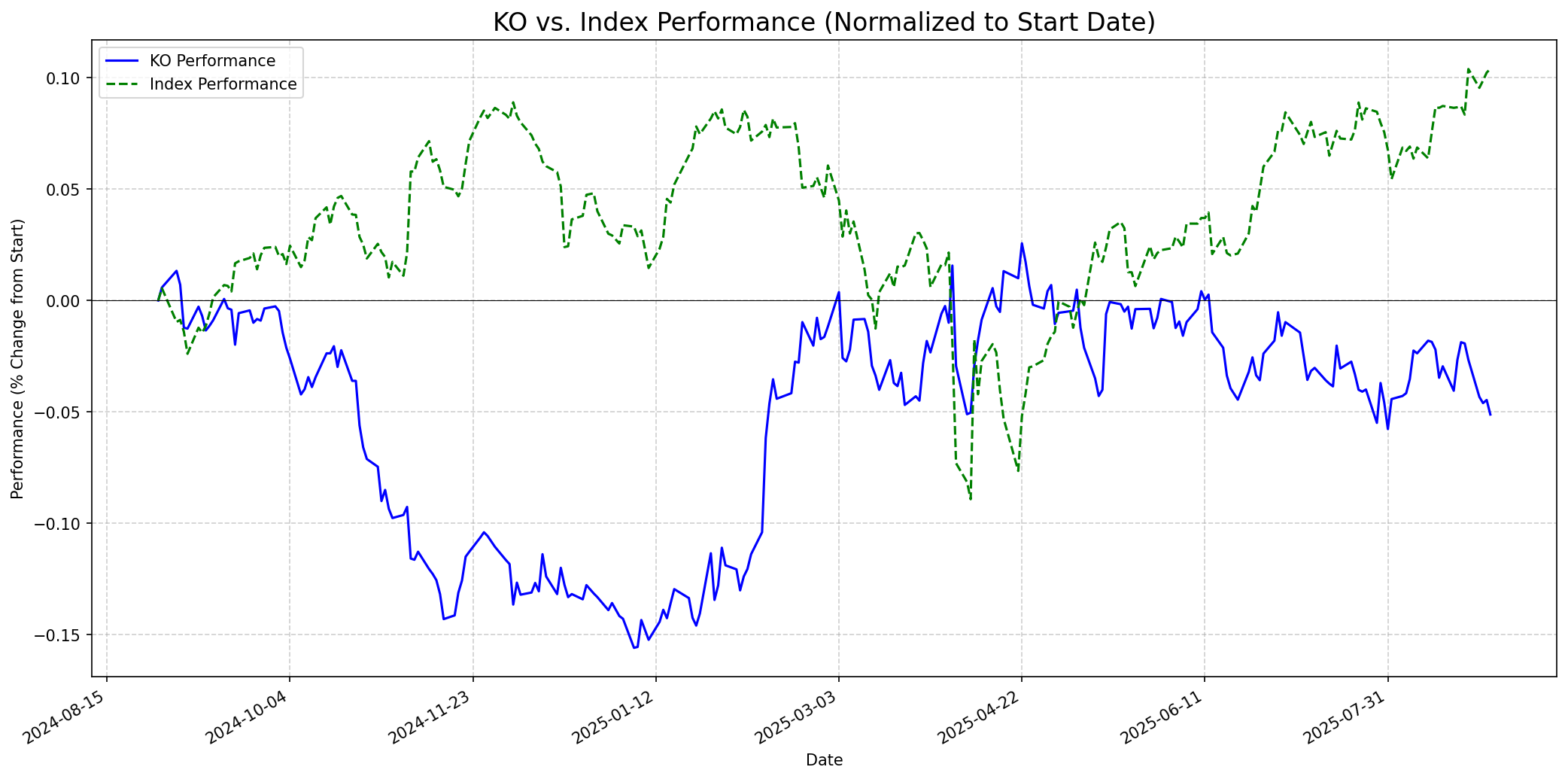

Stock Relative to Index

KO's performance compared to its index.

Social Media Sentiment

Reddit: Neutral/Mixed

Recent discussions on Reddit regarding KO stock are limited for August 2025. A post from October 2024 considered KO a 'good entry point' as a long-term hold, and a February 2025 post requested analysis. The most recent mention in an 'r/stocks Daily Discussion' thread (August 29, 2025) noted KO in a watchlist with other stocks, but provided no specific sentiment or detailed arguments. Due to the lack of recent, specific, and widespread discussion, the overall sentiment remains neutral to mixed.

Twitter/X: Neutral/Mixed

Current real-time sentiment from Twitter/X for Coca-Cola ($KO) is difficult to definitively ascertain due to a lack of recent, widely trending hashtags or specific influential discussions in the provided search results for August 2025. General news mentions and analyst outlooks are present, but a consolidated social media sentiment from individual investors on Twitter/X specifically is not available. Therefore, the sentiment is assessed as neutral to mixed, awaiting more direct social media data.

Fundamentals

Coca-Cola (KO) exhibits strong fundamental characteristics, supported by its Q2 2025 earnings. The company reported EPS of $0.87, surpassing the consensus estimate of $0.83, driven by substantial margin expansion with gross margin at 62.4% and operating margin at 34.1%. Diluted Earnings Per Share (YoY growth rate) was 27.91% and Net Profit (YoY growth rate) was 27.77%, indicating robust profitability. The Return on Equity (ROE) stands at 12.60%, and Net Profit Margin at 30.34%, ranking highly within the non-alcoholic beverages industry. However, some concerns temper the positive outlook. Revenue for Q2 2025 slightly missed expectations at $12.50 billion against a $12.55 billion consensus, and global unit case volume declined by 1%. Furthermore, currency headwinds negatively impacted Q2 EPS by 11 points and are projected to be a 5% headwind to comparable EPS for the full fiscal year 2025. The company's operating cash flow saw a significant decline of -133.82%, raising a red flag. Valuation metrics also indicate a high premium, with a Price-to-Sales ratio of 6.27 compared to the industry average of 2.85, and an EV/EBIT of 60.64. Its debt-to-equity ratio of 1.87 is higher than the industry average. Despite these challenges, analysts maintain a largely positive outlook, with a consensus rating of 'Strong Buy' or 'Buy'. Coca-Cola is recognized as a 'Dividend King' with a consistent history of dividend growth, providing a stable income stream for investors. The company anticipates organic revenue growth of 5-6% for 2025, driven by pricing strategies and gains in emerging markets, alongside successful product initiatives like Fairlife.

Performance Analysis (Last Year)

Performance: Underperformed

Over the last 365 days, The Coca-Cola Company (KO) significantly underperformed the broader market. The stock's closing price declined from approximately $72.05 to $68.36, representing a decrease of about 5.12%. In contrast, the provided index (likely representing a broad market index like the Dow Jones Industrial Average) saw an increase from approximately $41,335.05 to $45,636.89, a gain of about 10.41%. This substantial disparity indicates a clear underperformance by KO. The underperformance can be attributed to several factors. In Q2 2025, KO reported a 1% decline in global unit case volume, partly due to strong prior-year comparisons and adverse weather in key international markets like Mexico and India. Persistent currency headwinds also significantly impacted EPS, reducing it by 11 points in Q2 and projected to be a 5% headwind for comparable EPS in fiscal year 2025. Weak technical indicators, including a low internal diagnostic score of 2.8/10, bearish signals like a MACD death cross, and bearish engulfing patterns, have also contributed to negative sentiment. Despite strong fundamentals such as 12.60% ROE and 27.91% EPS growth, institutional caution has been observed. However, it's worth noting some positive developments within the year. Coca-Cola experienced a 15% stock price surge in Q1 2025, driven by its robust dividend track record, strategic diversification into non-carbonated beverages like Fairlife, digital transformation efforts, and other strategic investments. The company also reported market-share gains across its beverage portfolio in 2024. Despite these internal strengths, the cumulative effect of macroeconomic pressures, currency fluctuations, and specific market challenges led to its underperformance relative to the rising index over the full year.

Future Outlook

One Week

Price Target: $69.0

Performance vs Index: In-line

In the immediate one-week outlook (August 29 - September 5, 2025), KO's price is expected to remain relatively stable. The stock closed around $68.83 on August 27, 2025. CoinCodex's algorithm projects a slight increase to an average of $68.70 for August, with a range up to $69.46, suggesting limited upside by month-end. [1, 4] The upcoming Barclays Global Consumer Staples Conference on September 3, 2025, could offer minor catalysts, but significant price movement is unlikely given recent technical weakness and a relatively neutral short-term sentiment. Technical analysis by AltIndex shows a 46% likelihood of the price going up on August 30. [20] Performance is expected to be in-line with the index, as no strong immediate drivers for outperformance are apparent.

One Month

Price Target: $70.5

Performance vs Index: In-line

For the one-month period (August 29 - September 29, 2025), a slight positive trend is anticipated for KO. CoinCodex forecasts an average price of $69.97 for October, with a potential trading range between $66.84 and $72.60. [1] Analysts have a generally positive outlook, with an average brokerage recommendation (ABR) of 1.24 ('Strong Buy' to 'Buy') based on 25 firms. [31] Q3 2025 EPS estimates are stable at $0.79. [7, 14] While fundamentals are strong, persistent currency headwinds and a still-weak technical outlook could limit significant gains. Therefore, KO is likely to perform in-line with or slightly underperform the broader market, which may continue its upward trajectory.

One Year

Price Target: $78.0

Performance vs Index: Outperform

The one-year outlook for Coca-Cola (KO) is positive, with a strong potential for outperformance. Wall Street analysts maintain a consensus 'Strong Buy' rating, with an average 12-month price target ranging from $77.00 to $79.91, representing a potential upside of 12.64% to 16.1% from current levels. [3, 4, 10, 22, 31] The long-term growth is supported by durable pricing strategies, market-share gains in emerging markets, and successful product initiatives. The company anticipates organic revenue growth of 5-6% for 2025 and an 8.3% increase in EPS for the next fiscal year. [7, 18, 21, 34] As a 'Dividend King' with a strong brand and global presence, KO offers stability, which can be particularly attractive in a potentially volatile market, allowing it to outperform. Strategic restructuring efforts aimed at improving resource allocation are also expected to contribute to better market share performance and growth opportunities. [18] Despite some valuation concerns, the consistent dividend payouts and defensive business characteristics make it a compelling long-term hold. [3, 17, 24, 34, 42]

Latest News

FANTA® TEAMS UP WITH UNIVERSAL PICTURES AND BLUMHOUSE FOR GLOBAL PARTNERSHIP

On August 27, 2025, Fanta announced a global partnership with Universal Pictures and Blumhouse, bringing together horror icons. This marketing initiative could boost Fanta's brand visibility and sales, positively impacting Coca-Cola's overall revenue, particularly among younger demographics and during key seasonal events. [12, 32]

Coca-Cola Reports Second Quarter 2025 Results and Updates Full Year Guidance

On July 22, 2025, Coca-Cola reported Q2 2025 earnings, with EPS of $0.87 beating the consensus estimate of $0.83, but revenues of $12.50 billion falling slightly below the $12.55 billion consensus. The company demonstrated substantial margin improvements, with gross margin reaching 62.4% and operating margin jumping to 34.1%. However, global unit case volume declined by 1% due to strong prior-year comparisons and adverse weather, and currency headwinds reduced EPS by 11 points. [6, 12, 14, 25, 36, 37]

Coca-Cola Company Names New Leader for Europe Operating Unit

On July 18, 2025, The Coca-Cola Company announced a new leader for its Europe Operating Unit. This is a standard corporate governance update and is unlikely to have a significant immediate impact on stock performance, though it could signal strategic shifts in the European market over time. [32]

Concerns over Slow Growth in Beverage Sector and Potential Costa Coffee Deal Markdown

Coca-Cola shares have slipped amid mixed news, with concerns over slow growth in the beverage sector and a potential markdown on its Costa Coffee deal being notable negative factors. These broader industry challenges and specific asset performance issues could weigh on investor sentiment. [11]

Rumors

No recent rumors found.

Overview

Snapshot

Short-term Outlook

1-Year Outlook

The one-year outlook for Coca-Cola (KO) is positive, with a strong potential for outperformance. Wall Street analysts maintain a consensus 'Strong Buy' rating, with an average 12-month price target ranging from $77.00 to $79.91, representing a potential upside of 12.64% to 16.1% from current levels. [3, 4, 10, 22, 31] The long-term growth is supported by durable pricing strategies, market-share gains in emerging markets, and successful product initiatives. The company anticipates organic revenue growth of 5-6% for 2025 and an 8.3% increase in EPS for the next fiscal year. [7, 18, 21, 34] As a 'Dividend King' with a strong brand and global presence, KO offers stability, which can be particularly attractive in a potentially volatile market, allowing it to outperform. Strategic restructuring efforts aimed at improving resource allocation are also expected to contribute to better market share performance and growth opportunities. [18] Despite some valuation concerns, the consistent dividend payouts and defensive business characteristics make it a compelling long-term hold. [3, 17, 24, 34, 42]