Tip: start typing a company name to see suggestions. Press Enter or click Go to open its analysis page.

Market Performance Visuals

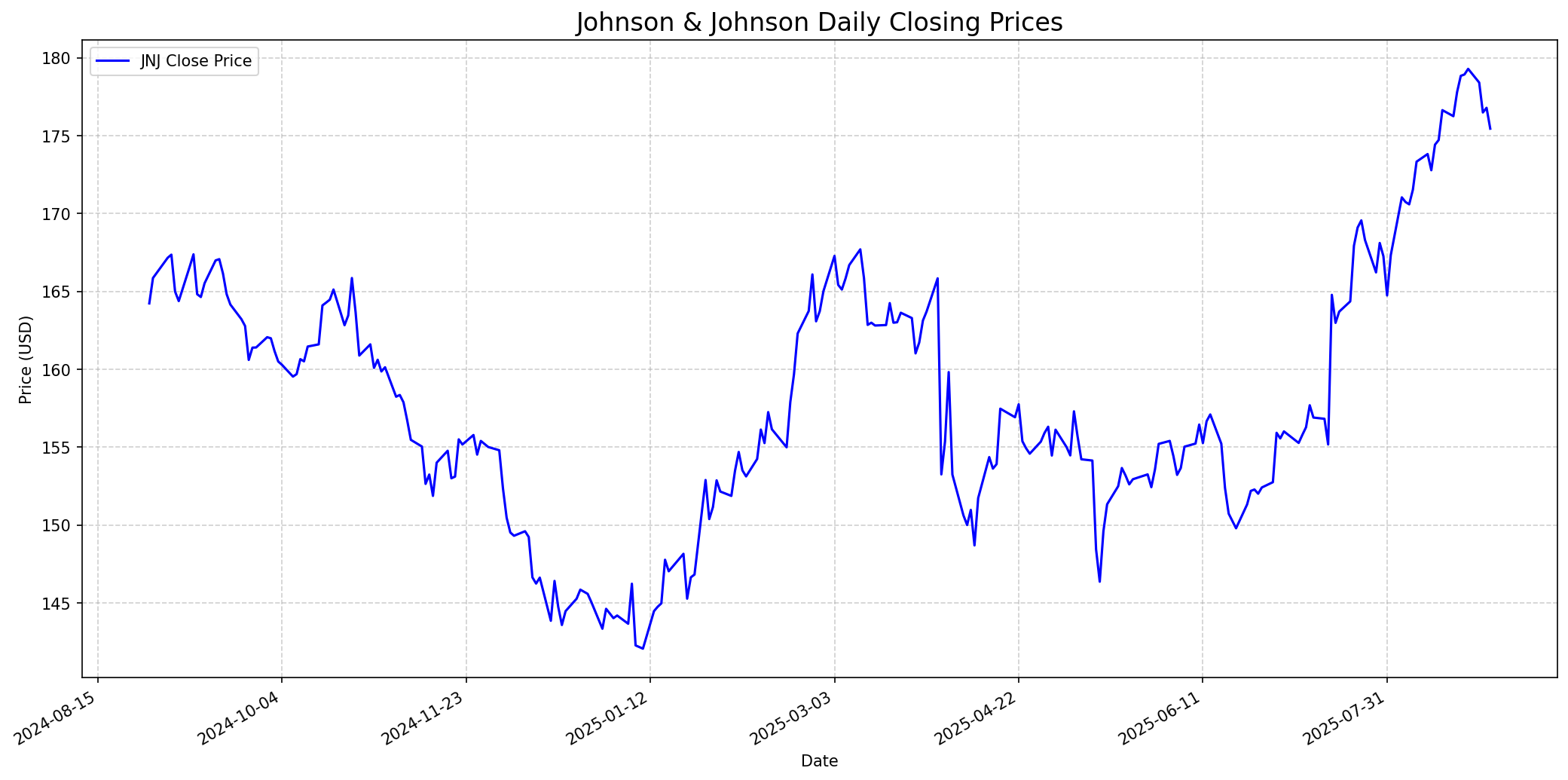

Stock Performance

Daily closing price of JNJ.

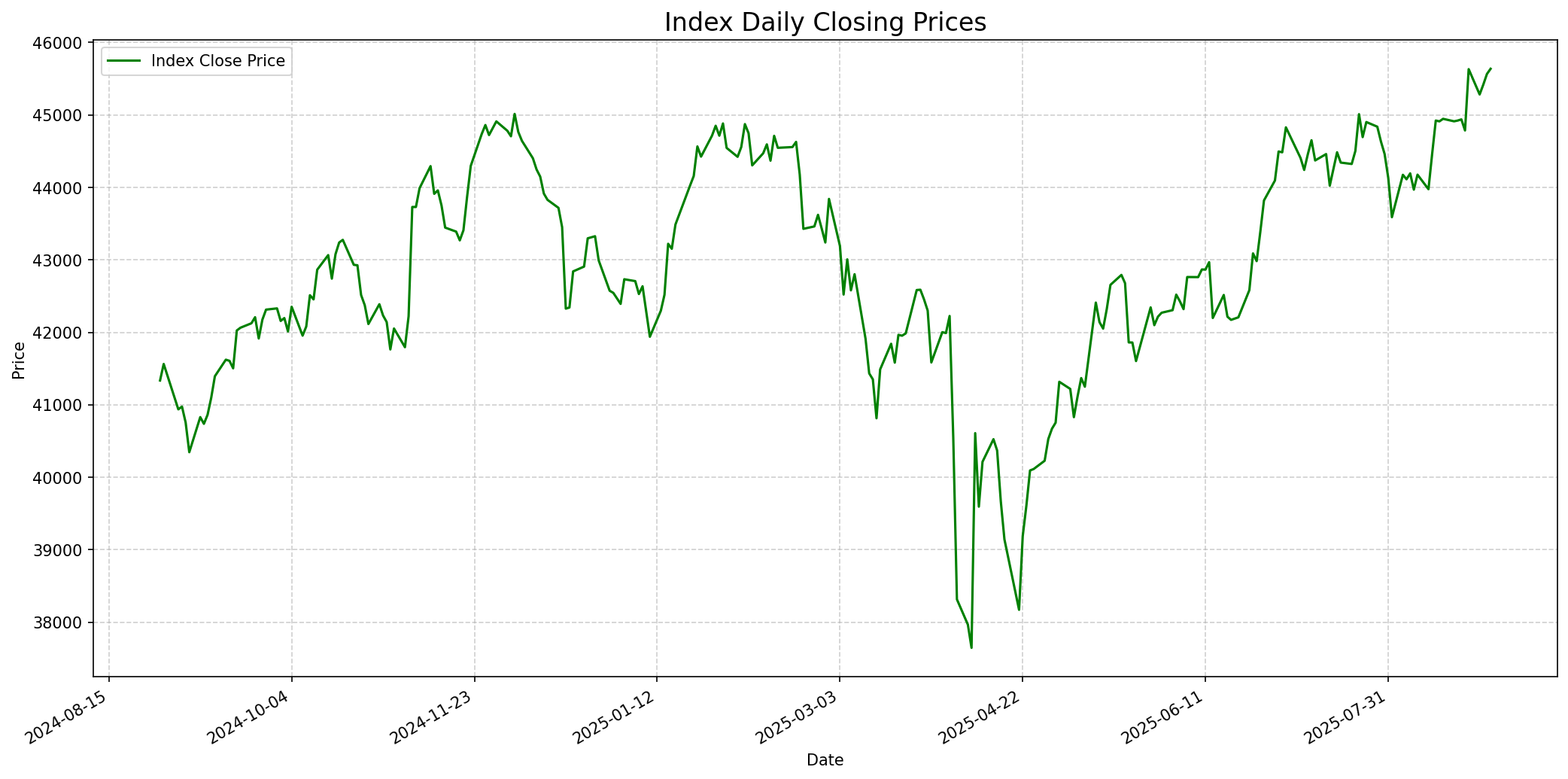

Relevant Index Performance

Performance of the relevant market index.

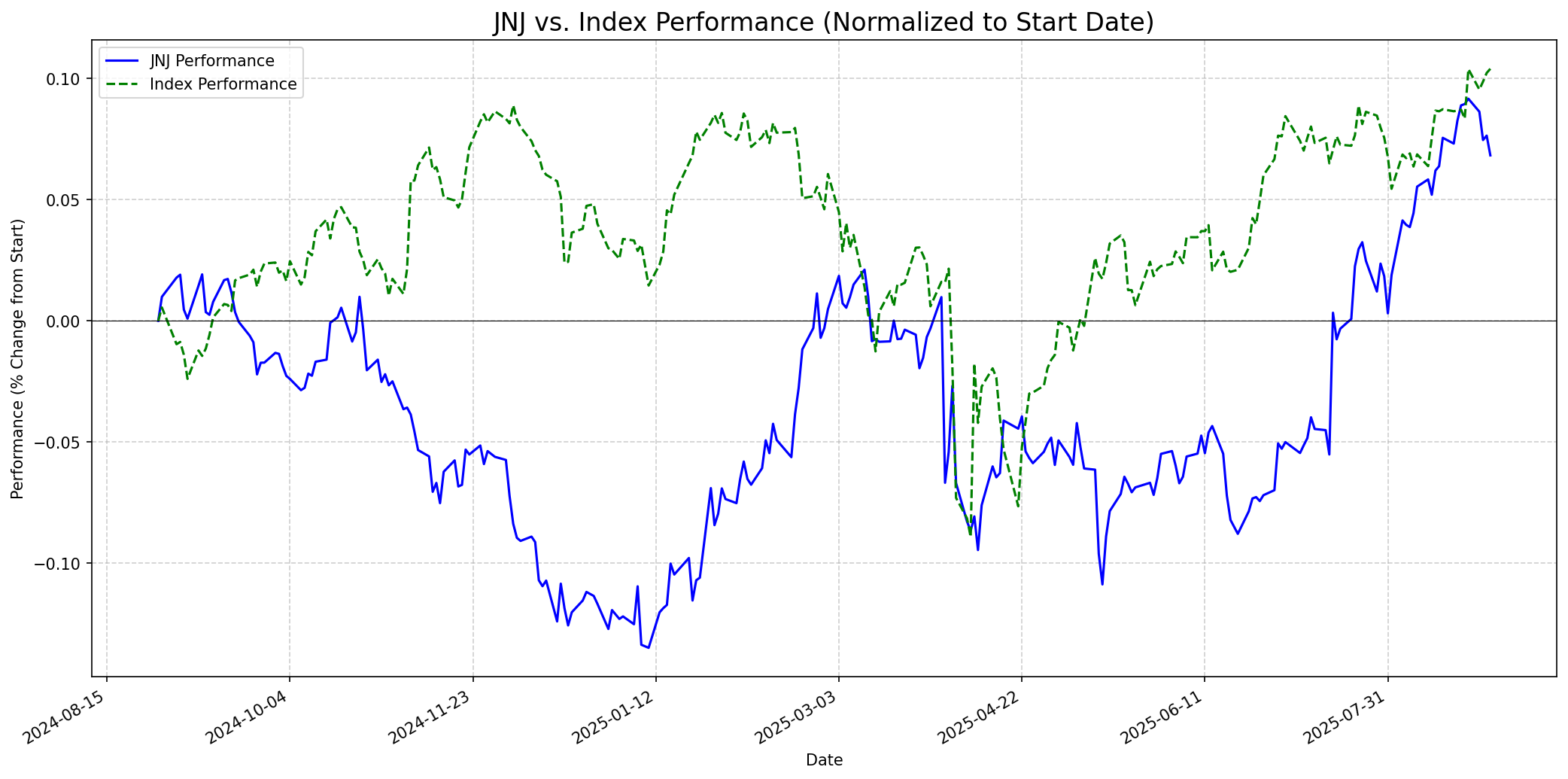

Stock Relative to Index

JNJ's performance compared to its index.

Social Media Sentiment

Reddit: Mixed

Recent discussions on Reddit regarding JNJ stock show a mixed sentiment. While some users, especially in January 2025, discussed the stock being 'hammered' and considered it a 'buy the dip' opportunity for long-term investment, others, as late as June 2025, expressed bearish views, citing a multi-year downtrend and poor 5-year returns even after adjusting for dividends. The ongoing talc legal issues are a consistent theme, with some users adjusting growth projections downwards due to these liabilities. The general feeling is cautious, acknowledging JNJ's dividend strength but questioning its growth prospects amidst legal challenges and past underperformance.

Twitter/X: Slightly Bullish

While direct sentiment analysis from Twitter/X was not provided, the overall news flow related to JNJ in July and August 2025 suggests a generally positive sentiment. The strong Q2 2025 earnings beat, raised full-year guidance, and significant investment in US manufacturing are likely to be viewed favorably. However, the recent news about the discontinuation of an arthritis drug trial and the persistent legal challenges may temper overly bullish enthusiasm, leading to a 'Slightly Bullish' sentiment as the market digests both positive developments and ongoing hurdles. No specific key influencers or trending hashtags were identified in the search results.

Fundamentals

Johnson & Johnson (JNJ) maintains a robust fundamental profile, characterized by its diversified business model spanning Innovative Medicine (pharmaceuticals) and MedTech (medical devices), following the 2023 spin-off of its Consumer Health business (Kenvue). The company delivered strong Q2 2025 results, exceeding revenue and adjusted EPS expectations and subsequently raising its full-year 2025 guidance. Key growth drivers include its oncology and immunology franchises, such as DARZALEX and CARVYKTI, and a strong MedTech segment boosted by cardiovascular and electrophysiology products. JNJ is a 'Dividend King,' with 64 consecutive years of dividend increases, boasting a current yield of around 2.9-3.0%, underscoring its financial stability and commitment to shareholder returns. The company also invests significantly in R&D, with $15.5 billion in 2024, to fuel its robust pipeline. While JNJ faces ongoing legal challenges related to talcum powder lawsuits, which have resulted in billions in settlements and continue to be a reputational and financial headwind, the company is actively managing these issues. Institutional investors show significant confidence in JNJ, with substantial net inflows. However, the stock's valuation multiples, such as EV/EBIT (61.11) and Price-to-Sales (17.50x), suggest a potentially stretched valuation despite strong earnings potential.

Performance Analysis (Last Year)

Performance: Underperformed

Over the last 365 days, Johnson & Johnson (JNJ) underperformed its index. JNJ's stock price increased by approximately 6.83% from $164.23 to $175.45, while the provided index saw a gain of about 10.41% from $41,335.05 to $45,636.90. This underperformance can be attributed to several factors. The persistent overhang of talcum powder litigation has significantly impacted investor sentiment, with billions in legal settlements and ongoing court battles throughout the period, including rejected bankruptcy filings and continued awards to plaintiffs. The company also faced headwinds from the loss of exclusivity for its key immunology drug, Stelara, which negatively impacted adjusted EPS growth. While the strategic spin-off of Kenvue in 2023 was a long-term positive for focusing on higher-margin businesses, it likely caused short-term adjustments and re-evaluation by investors. Despite these challenges, JNJ demonstrated resilience, particularly in the latter half of the period, with strong Q2 2025 earnings exceeding expectations, robust performance in its Innovative Medicine and MedTech segments, and several positive product approvals like IMAAVY in April 2025 and expanded CARVYKTI approval in April 2024. These positive catalysts, along with a significant $2 billion manufacturing investment announced in August 2025 , contributed to a year-to-date outperformance in 2025, but were not enough to overcome the earlier drag from legal and competitive pressures for the entire 52-week period.

Future Outlook

One Week

Price Target: $176.5

Performance vs Index: In-line

In the coming week, JNJ's stock is likely to trade in-line with the broader market, possibly experiencing slight upward momentum. The positive sentiment from the strong Q2 2025 earnings report and raised full-year guidance, along with the recent manufacturing investment announcement, should provide support. However, immediate upward catalysts are limited, and market participation in the upcoming Wells Fargo Healthcare Conference on September 3, 2025, may generate some investor attention. [32]

One Month

Price Target: $178.0

Performance vs Index: Outperform

Over the next month, JNJ is expected to moderately outperform its index. The momentum from the robust Q2 results and increased 2025 outlook should continue to fuel investor confidence. The company's participation in the Wells Fargo and Morgan Stanley Healthcare Conferences in early September 2025 provides platforms for management to reiterate its positive outlook and potentially discuss pipeline developments, which could act as catalysts. [32, 33] The strategic focus on high-growth pharmaceuticals and medical technologies, coupled with ongoing pipeline progress, supports a positive short-term outlook, despite the discontinuation of one arthritis drug trial. [16, 20]

One Year

Price Target: $185.0

Performance vs Index: Outperform

For the one-year outlook, Johnson & Johnson is positioned to outperform its index, reflecting the current analyst consensus of 'Buy' and an average price target that suggests modest upside. [1, 3, 4, 5, 39] The company's strategic pivot towards higher-margin Innovative Medicine and MedTech segments, bolstered by a strong R&D pipeline and recent product approvals like IMAAVY for gMG and expanded CARVYKTI for multiple myeloma, provides a solid foundation for growth. [2, 12, 15, 17, 25, 27, 30] While talcum powder litigation remains an ongoing concern, the market appears to be largely pricing in these liabilities, and the company's consistent dividend increases (Dividend King status) make it an attractive long-term investment. Continued capital allocation towards strategic acquisitions and manufacturing expansions further strengthens its market position and growth prospects. [6, 9, 12, 17, 40]

Latest News

Johnson & Johnson Reports Strong Q2 2025 Results and Raises Full-Year Outlook

Johnson & Johnson announced strong second-quarter 2025 results, with reported sales growth of 5.8% to $23.7 billion and adjusted EPS of $2.77, both exceeding analyst expectations. The company also raised its full-year 2025 guidance for both sales and adjusted EPS, driven by strong performance in its Innovative Medicine and MedTech segments. This positive earnings report is likely to boost investor confidence and support the stock price. [15, 18, 19]

Johnson & Johnson Commits $2 Billion to U.S. Manufacturing Expansion

Johnson & Johnson announced a $2 billion commitment over the next 10 years to expand its U.S. manufacturing capacity, including a new 160,000+ square foot facility in North Carolina. This investment reinforces the company's leadership in healthcare solutions and aims to manufacture the majority of advanced medicines in the U.S. to meet patient needs. This strategic move could enhance supply chain resilience and generate positive sentiment. [6, 9]

J&J Halts Development of Combination Arthritis Drug After Trial Setback

Johnson & Johnson has discontinued the development of a combination therapy involving its experimental antibody therapy, nipocalimab, for rheumatoid arthritis following a setback in a mid-stage trial. The Phase 2a study showed no significant additional benefits over existing anti-TNFα therapy. While nipocalimab is being investigated for other conditions, this specific setback in a competitive area could slightly dampen enthusiasm for JNJ's immunology pipeline in the short term. [16, 20]

Rumors

Talc Lawsuit Concerns Impacting Long-Term Projections on Social Media

Discussions on social media platforms like Reddit frequently circle back to the long-running talcum powder lawsuits against Johnson & Johnson. While not a new 'rumor,' ongoing legal battles and the associated financial liabilities and reputational damage continue to be a point of speculation and concern among some investors, influencing their long-term growth assumptions and fair value estimates for the stock. This sentiment suggests that the legal overhang, despite being largely priced in, still contributes to a degree of uncertainty among retail investors. [31, 37]

Overview

Snapshot

Short-term Outlook

1-Year Outlook

For the one-year outlook, Johnson & Johnson is positioned to outperform its index, reflecting the current analyst consensus of 'Buy' and an average price target that suggests modest upside. [1, 3, 4, 5, 39] The company's strategic pivot towards higher-margin Innovative Medicine and MedTech segments, bolstered by a strong R&D pipeline and recent product approvals like IMAAVY for gMG and expanded CARVYKTI for multiple myeloma, provides a solid foundation for growth. [2, 12, 15, 17, 25, 27, 30] While talcum powder litigation remains an ongoing concern, the market appears to be largely pricing in these liabilities, and the company's consistent dividend increases (Dividend King status) make it an attractive long-term investment. Continued capital allocation towards strategic acquisitions and manufacturing expansions further strengthens its market position and growth prospects. [6, 9, 12, 17, 40]