Tip: start typing a company name to see suggestions. Press Enter or click Go to open its analysis page.

Market Performance Visuals

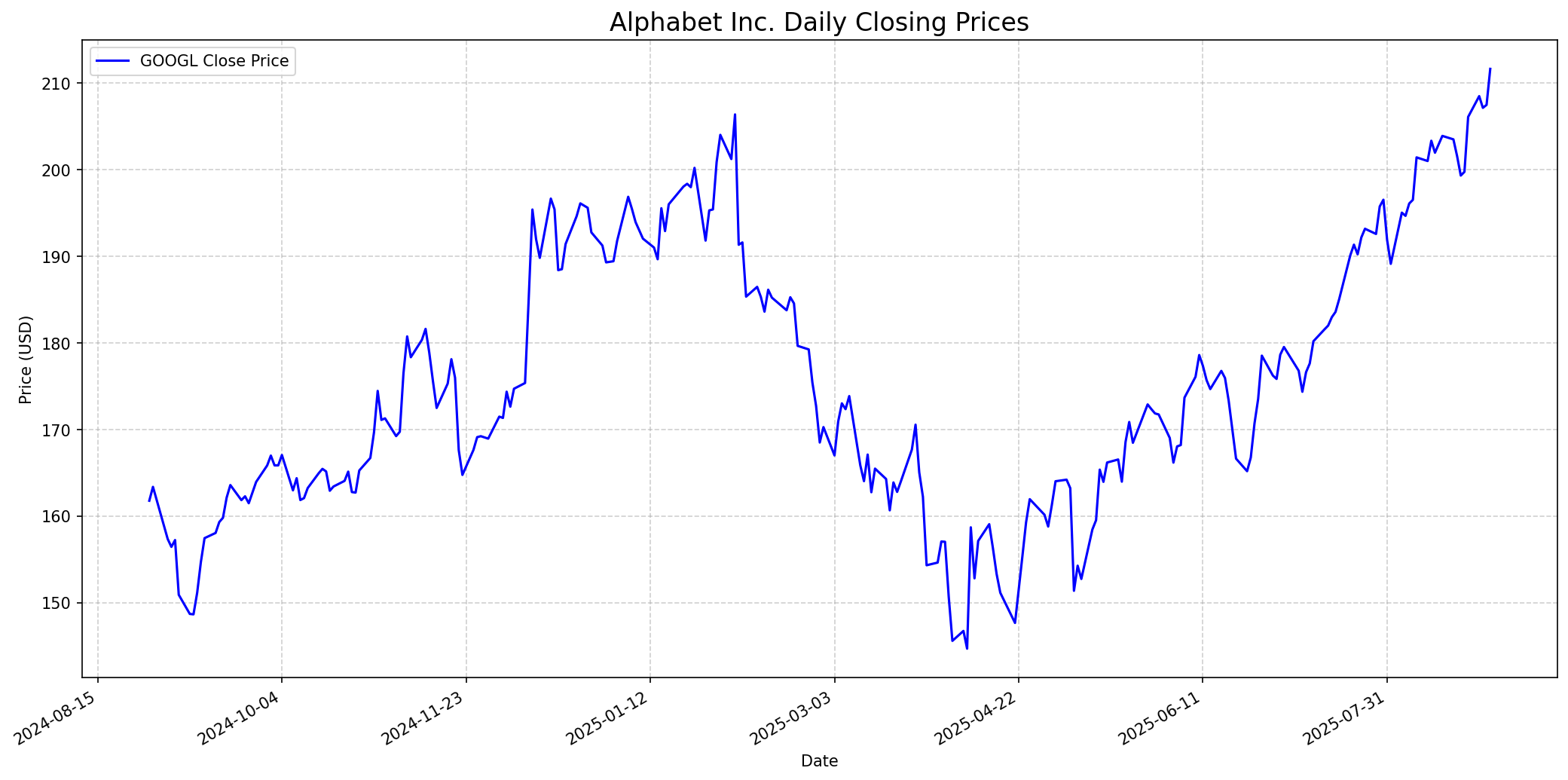

Stock Performance

Daily closing price of GOOGL.

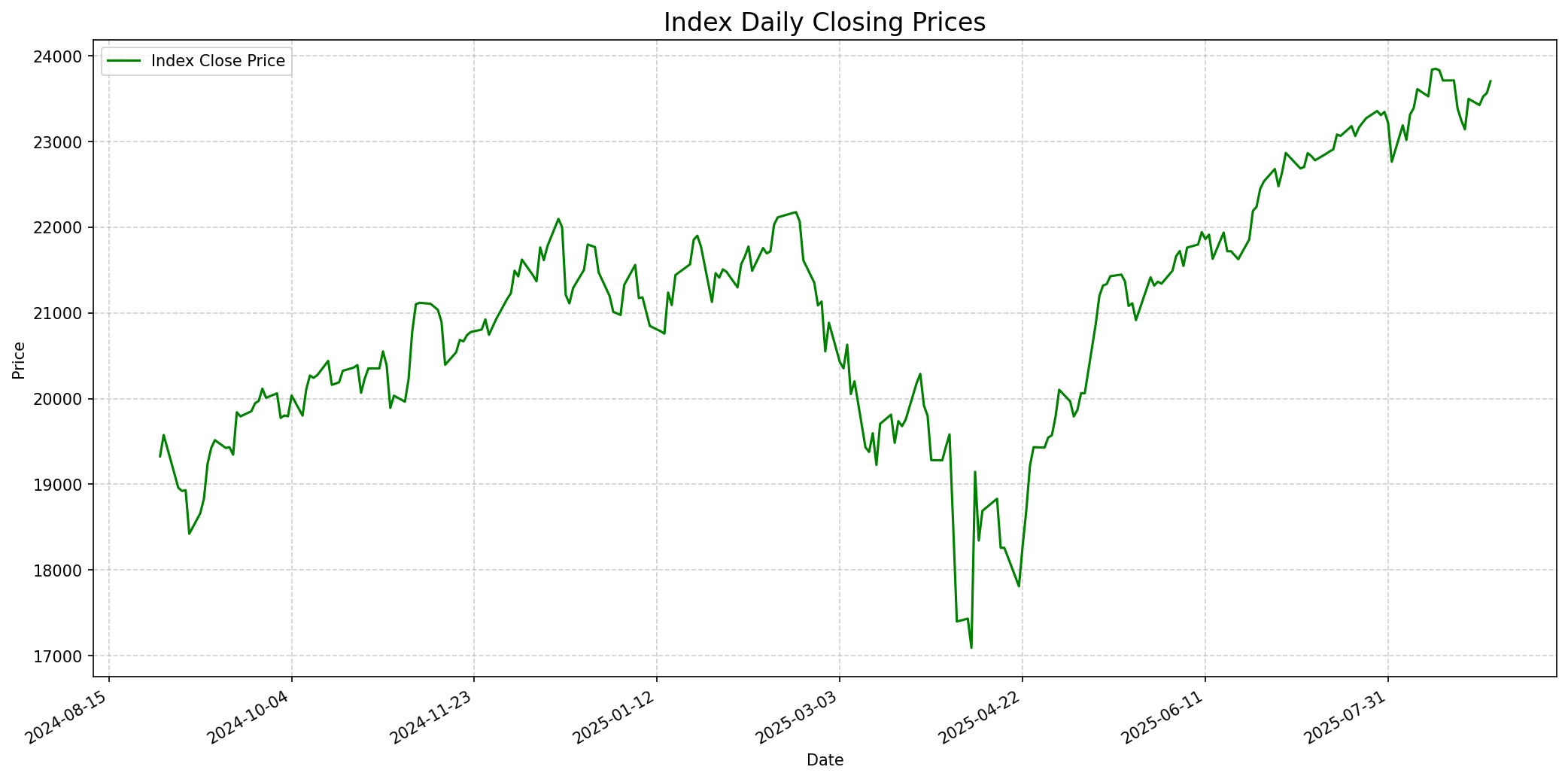

Relevant Index Performance

Performance of the relevant market index.

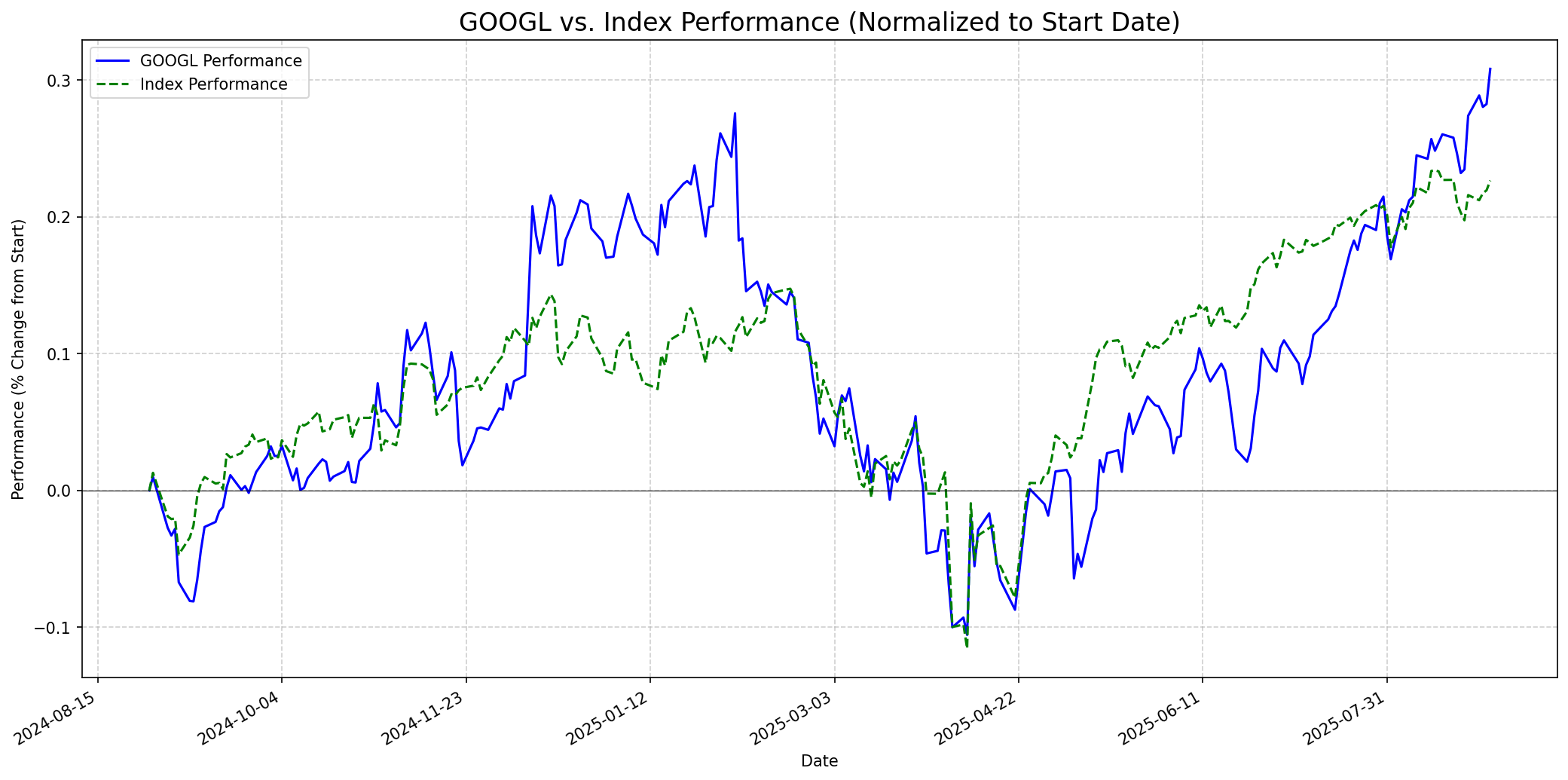

Stock Relative to Index

GOOGL's performance compared to its index.

Social Media Sentiment

Reddit: Bullish

Recent discussions on Reddit, particularly on 'WallStreetBets', indicate a bullish sentiment for GOOGL, with the stock being among the top trending mentions. While detailed sentiment analysis of individual posts is not available, the significant positive news flow, including strong Q2 earnings and the major cloud deal with Meta, suggests a generally optimistic outlook among retail investors and traders. Themes likely revolve around Google's AI advancements, cloud growth, and overall market dominance.

Twitter/X: Bullish

Sentiment on Twitter/X regarding GOOGL is largely bullish, driven by the company's recent strong Q2 2025 earnings report, the substantial $10 billion Google Cloud deal with Meta, and ongoing advancements in AI integration across its product ecosystem (e.g., Pixel 10, Gemini AI). Analysts' reaffirmed 'Buy' ratings and positive price target revisions also contribute to the positive sentiment. Key influencers and trending hashtags likely emphasize Google's innovation in AI, its strong financial performance, and its strategic partnerships, positioning it as a leader in the evolving tech landscape.

Fundamentals

Alphabet Inc. (GOOGL) exhibits strong fundamentals, ranking better than 70% of companies in terms of growth, profitability, debt, and overall visibility. The company boasts exceptionally high margins before interest, taxes, depreciation, and amortization, signifying its core operations generate substantial profits. Alphabet's financial health is robust, providing ample flexibility for future investments. Analysts have shown increasing optimism, consistently revising EPS and sales forecasts upwards over the past year. GOOGL has demonstrated strong annual EPS growth of 26.97% and yearly revenue growth of 13.13%, with an average annual EPS growth of 25.25% over several years. Its Altman-Z score of 13.26 and a low Debt to FCF ratio of 0.40 further highlight its financial strength. Despite these strengths, the company's current valuation appears high, estimated to be overvalued by approximately 18% based on intrinsic value assessments. Historically, Alphabet has not been a high-dividend payer, though it recently initiated a quarterly dividend. Potential challenges include the ongoing impact of AI on traditional search economics, regulatory and antitrust pressures, and intense competition in the cloud market from rivals like AWS and Azure. However, its cash-rich core businesses (Search, YouTube), rapidly growing and now profitable Google Cloud, leadership in AI (DeepMind, Gemini, TPUs), and vast ecosystem of embedded defaults (Android, Chrome, Maps, Gmail) provide significant competitive advantages and avenues for future monetization.

Performance Analysis (Last Year)

Performance: Outperformed

Over the last 365 days, Alphabet Inc. (GOOGL) significantly outperformed its benchmark index. GOOGL's stock price increased by approximately 30.82% (from $161.78 to $211.64), while the index rose by about 22.65% (from $19325.45 to $23703.45). This strong performance can be attributed to several key factors. Alphabet delivered robust Q2 2025 earnings, surpassing analyst expectations across its core advertising, YouTube, and Google Cloud segments. The company's Google Cloud division showed remarkable growth (32% YoY revenue increase), which was further bolstered by a landmark $10 billion multi-year cloud deal with Meta to support its AI infrastructure. Significant advancements in AI, including the integration of Gemini into products like the Pixel 10 series and Pixel Watch 4, have instilled investor confidence in Google's ability to monetize its AI leadership. Positive analyst sentiment, characterized by numerous 'Strong Buy' ratings and upward revisions of price targets, also played a crucial role. While there were brief concerns about cloud revenue expectations and antitrust issues earlier in the year (around April 2025), the company's recent performance and strategic moves have largely alleviated these worries, driving the stock to new highs.

Future Outlook

One Week

Price Target: $212.5

Performance vs Index: Outperform

Given the very recent positive news regarding strong Q2 earnings, the Meta cloud deal, and ongoing AI integration driving an intraday surge, GOOGL is expected to continue its positive momentum in the short term. Investor confidence is high, and the stock is likely to slightly outperform the broader market as these catalysts are further absorbed. [11, 15, 32]

One Month

Price Target: $217.09

Performance vs Index: Outperform

The positive catalysts from late August, including the significant Meta deal and strong financial results, are expected to continue influencing GOOGL's performance over the next month. While some algorithms show mixed sentiment, analyst consensus remains largely bullish, predicting continued upward movement. Google's ongoing investments and strategic positioning in AI and cloud computing should support its outperformance against the index. [3, 11, 15, 32]

One Year

Price Target: $217.0

Performance vs Index: Outperform

Alphabet's long-term outlook remains strong, with analysts having an average one-year price target indicating further upside. The company's robust fundamentals, leadership in AI development (Gemini), continued growth in Google Cloud, and dominant position in digital advertising provide a solid foundation. Strategic initiatives, such as expanding AI integration across products and securing major cloud partnerships, are expected to drive sustained revenue and earnings growth, enabling GOOGL to outperform the broader market over the next year. [1, 2, 4, 5, 6, 7, 8, 11, 13, 20, 22, 23, 24]

Latest News

Alphabet Reports Strong Q2 2025 Results and Announces $10 Billion Cloud Deal with Meta

Alphabet (GOOGL) reported robust Q2 2025 financial results, exceeding Wall Street's expectations for both earnings and revenue, driven by its core advertising business, YouTube, and significant growth in Google Cloud and AI services. Concurrently, the company secured a substantial six-year, $10 billion cloud deal with Meta Platforms, underscoring Google Cloud's leadership in AI infrastructure and potentially boosting long-term growth. [11, 32]

GOOGL Surges on AI Integration, Hardware Innovation, and Regulatory Progress

Alphabet Inc. (GOOGL) experienced an intraday surge, reaching its highest level since August 2025, fueled by increasing investor confidence in its strategic direction. Key drivers include deep AI integration across its hardware and software ecosystem (e.g., Pixel 10 series, Pixel Watch 4 with Gemini AI), ongoing hardware innovation, and positive developments in regulatory progress, which are seen as critical for monetizing AI advancements. [15]

Alphabet Declares Quarterly Dividend, Signaling Return to Shareholder Compensation

Alphabet recently declared a quarterly dividend of $0.21 per share, payable on September 15th, 2025, to shareholders of record by September 8th. This move, representing an annualized dividend of $0.84 and a 0.4% yield, indicates the company's commitment to returning value to shareholders and reflects a strong financial position, with a dividend payout ratio of 8.95%. [17, 18]

Rumors

No recent rumors found.

Overview

Snapshot

Short-term Outlook

1-Year Outlook

Alphabet's long-term outlook remains strong, with analysts having an average one-year price target indicating further upside. The company's robust fundamentals, leadership in AI development (Gemini), continued growth in Google Cloud, and dominant position in digital advertising provide a solid foundation. Strategic initiatives, such as expanding AI integration across products and securing major cloud partnerships, are expected to drive sustained revenue and earnings growth, enabling GOOGL to outperform the broader market over the next year. [1, 2, 4, 5, 6, 7, 8, 11, 13, 20, 22, 23, 24]