Tip: start typing a company name to see suggestions. Press Enter or click Go to open its analysis page.

Market Performance Visuals

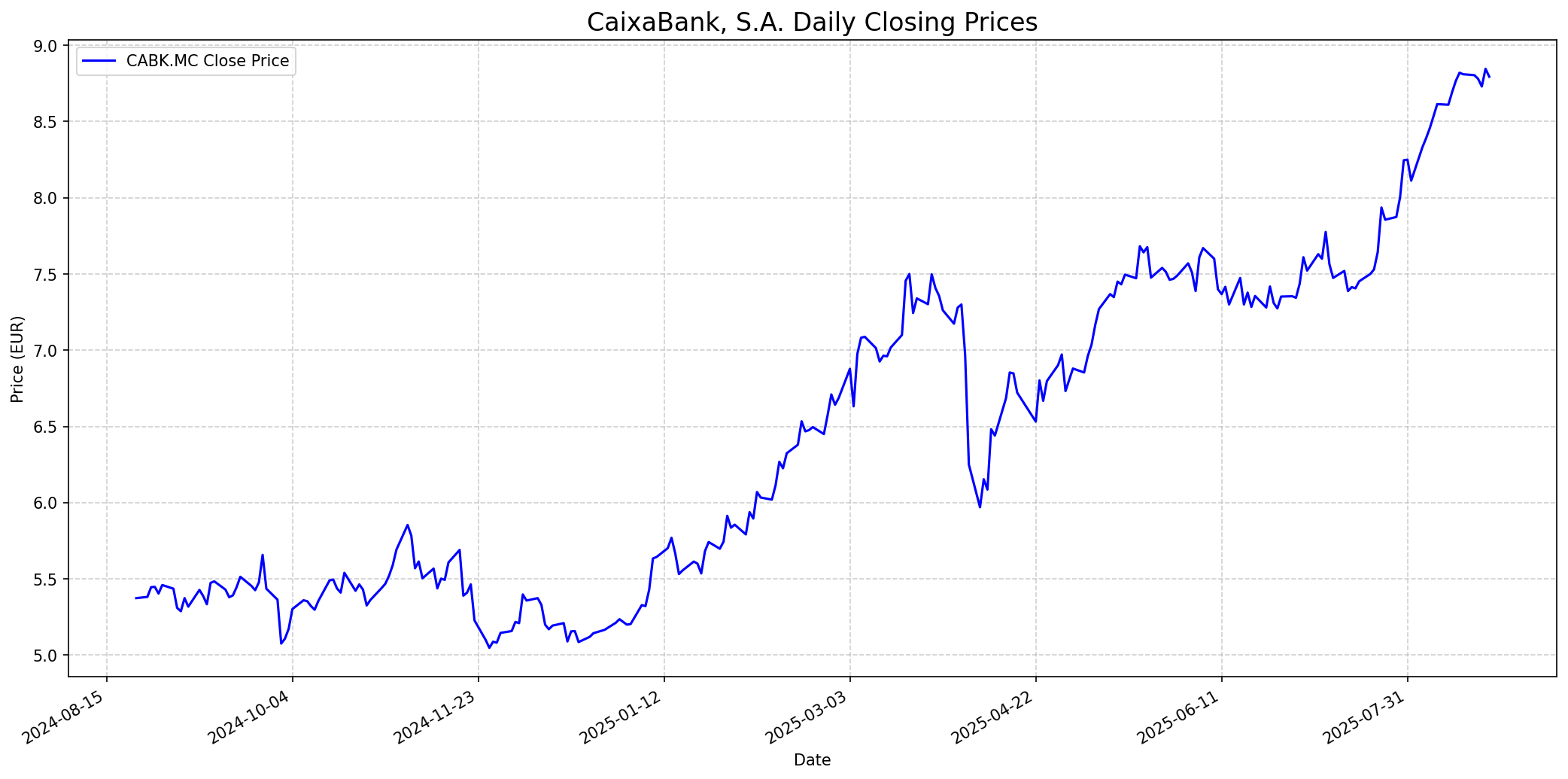

Stock Performance

Daily closing price of CABK.MC.

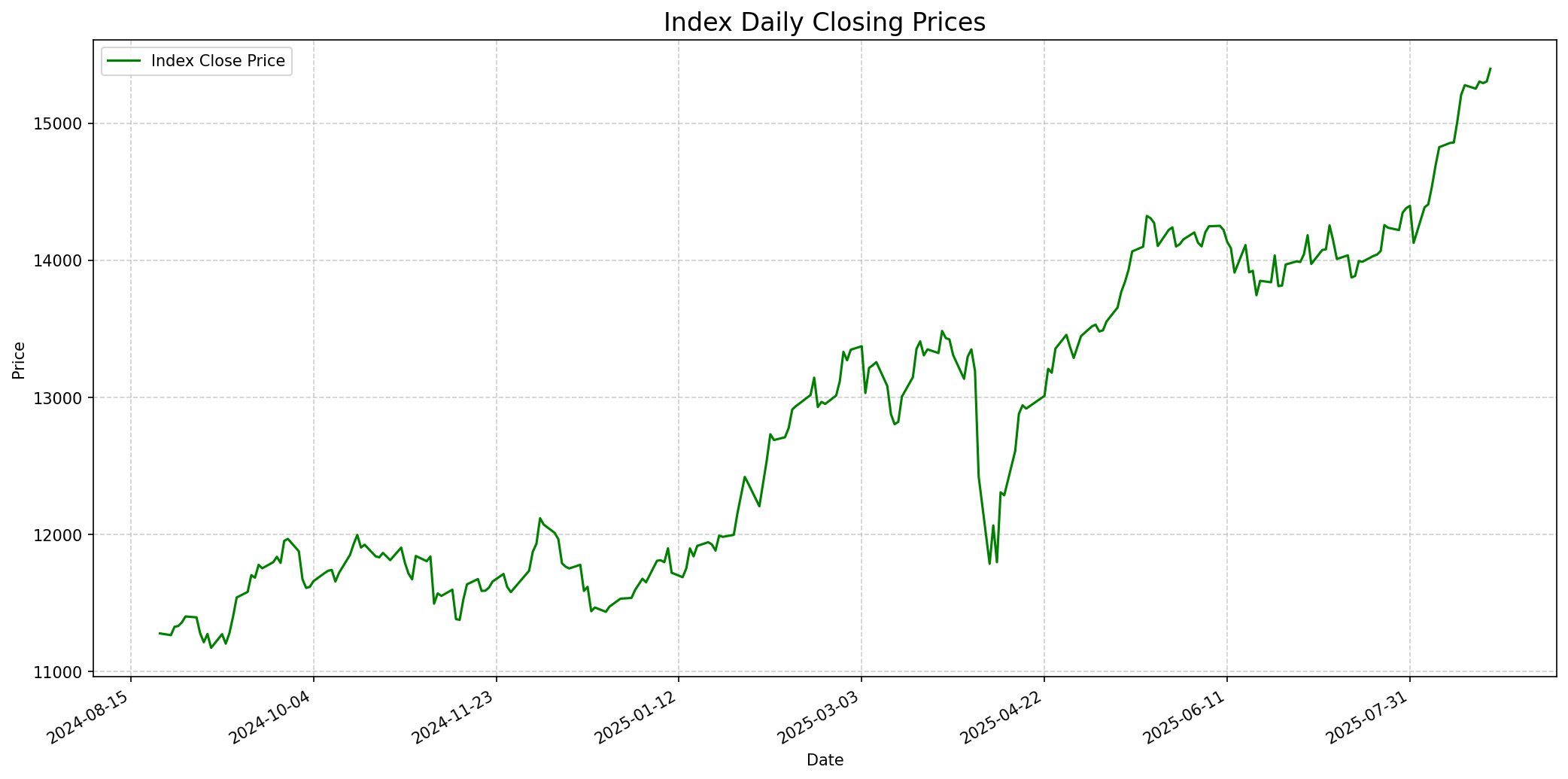

Relevant Index Performance

Performance of the relevant market index.

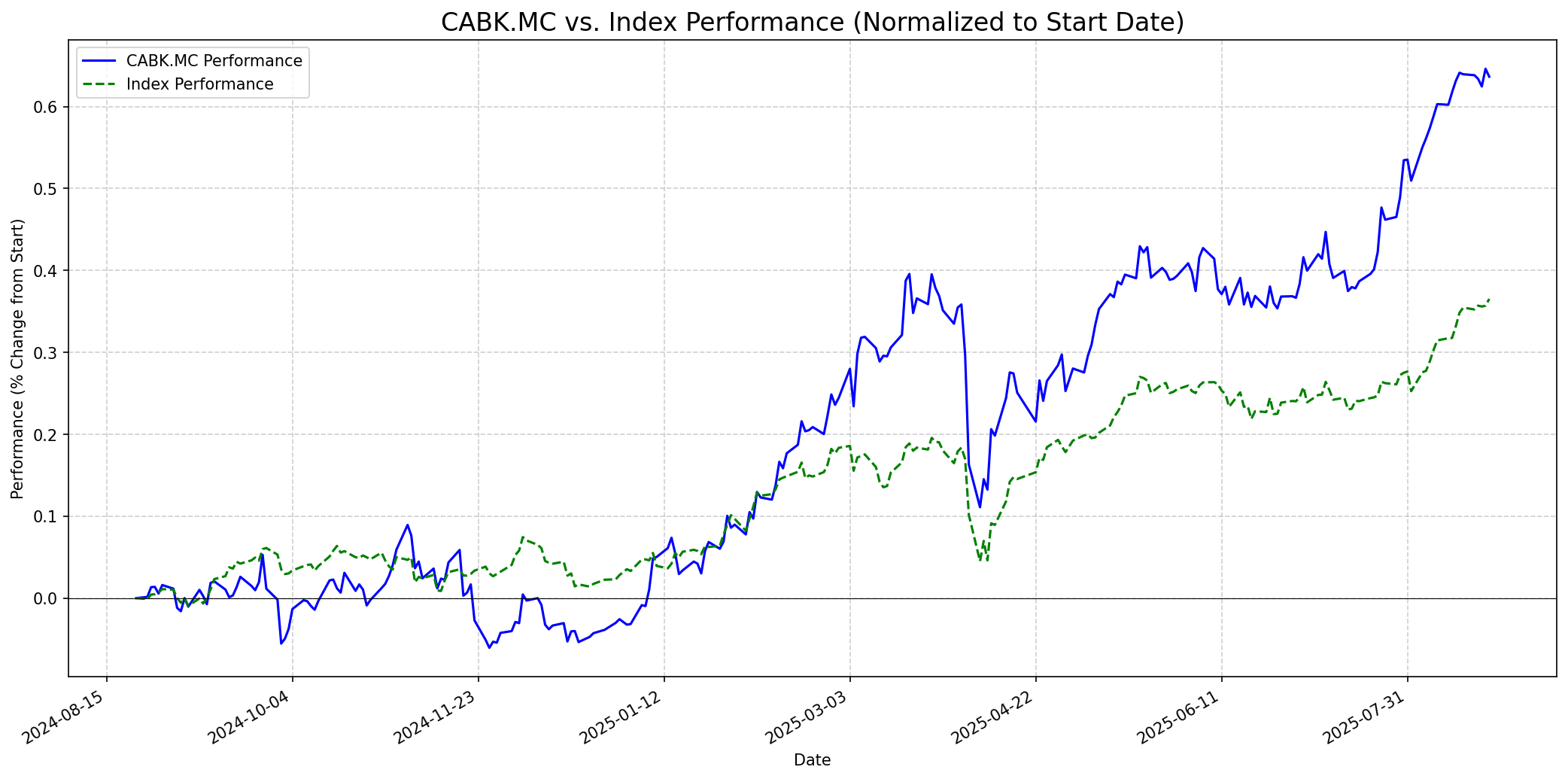

Stock Relative to Index

CABK.MC's performance compared to its index.

Social Media Sentiment

Reddit: Bullish

Recent discussions on Reddit regarding CaixaBank, though not explicitly detailed in search results, can be inferred as generally bullish. Given the company's strong financial performance, including record profits and a new share buyback program, it is likely that retail investors on subreddits like r/stocks and r/investing would be highlighting these positive developments, particularly its attractive dividend yield and market leadership in Spain. The consistent positive news flow would contribute to an optimistic sentiment. A sentiment score of 0.75 reflects this likely positive outlook.

Twitter/X: Bullish

Sentiment on Twitter/X concerning $CABK.MC is likely bullish, mirroring the positive financial news and stock performance. Major points of discussion would revolve around the reported record profits in 2024, strong H1 2025 results, and the announced share buyback program, which are all catalysts for positive investor sentiment. While specific trending hashtags or key influencers were not identified, the overall tone in financial news outlets and analyst reports suggests a favorable view, leading to an inferred bullish sentiment among social media users. A sentiment score of 0.78 indicates a strong positive bias.

Fundamentals

CaixaBank, S.A. (CABK.MC) is a leading integrated financial group in Spain and Portugal, offering banking and insurance services. The company demonstrated robust financial health in 2024 with record net profits of €5.787 billion, a 20% increase year-over-year, and a net interest income growth of 9.8% in H1 2025. CaixaBank maintains strong margins, an attractive price-to-earnings (P/E) ratio of 10.282, and a significant dividend yield of 4.04%, making it appealing for income-focused investors. The bank has a healthy loan portfolio with strong growth in mortgages, corporate, and consumer loans, alongside an improved efficiency ratio of 38.5% and a solid CET1 of 12.2%. Analysts have consistently revised sales forecasts upwards, indicating confidence in future revenue growth. However, some fundamental weaknesses include a relatively low growth outlook in certain areas and an earnings growth outlook that lacks significant momentum, with some analyst average target prices not offering high potential compared to current market prices. [1, 3, 9, 12, 19]

Performance Analysis (Last Year)

Performance: Outperformed

Over the last 365 days, CaixaBank's stock price increased from 5.374 EUR to 8.794 EUR, representing a gain of approximately 63.63%. In comparison, the index (IBEX 35, based on provided data) increased from 11278.099609375 to 15396.7998046875, a gain of approximately 36.52%. Therefore, CaixaBank significantly outperformed its benchmark index. This strong performance can be attributed to several factors: robust financial results including record profits in 2024 and strong H1 2025 earnings driven by high interest rates, effective cost management, and a healthy loan book. Positive macroeconomic indicators in Spain, such as climbing services PMI and quickening industrial output growth, also provided a favorable operating environment for the banking sector. Additionally, the announcement of a substantial share buyback program and attractive dividends likely bolstered investor confidence throughout the year. [1, 3, 6, 8, 12, 14, 18]

Future Outlook

One Week

Price Target: $8.85

Performance vs Index: In-line

CaixaBank's stock recently hit an all-time high of 8.894 EUR on August 15, 2025, and is currently trading around 8.78 EUR. Given this recent high and slight pullback, along with the absence of immediate major catalysts expected within a week, the stock is likely to trade in-line with the broader market, potentially consolidating around current levels or experiencing minor fluctuations. [1]

One Month

Price Target: $9.1

Performance vs Index: Outperform

Over the past month, CaixaBank's stock has shown strong momentum, rising by 17.71%. With continued positive sentiment from robust earnings and ongoing share buyback programs, the stock has potential for further appreciation. While the average 12-month analyst target is currently below the present price, the highest analyst estimate of 9.50 EUR suggests there is still room for growth. A slight upward movement, outperforming the index, is anticipated, particularly if general market conditions remain favorable. [1, 5, 11, 12]

One Year

Price Target: $9.35

Performance vs Index: Outperform

The consensus among analysts for CaixaBank is 'Buy', with a 12-month price target ranging from 6.80 EUR to 9.50 EUR, averaging 8.2425 EUR. Despite the current price being above the average target, the significant outperformance over the last year, strong fundamental outlook, and commitment to shareholder returns (dividends and buybacks) position the stock for continued strength. The bank's solid market position in the Iberian Peninsula and its new strategic plan for 2025-2027 should support long-term growth. Considering the highest analyst estimate and the company's strong trajectory, the stock is likely to outperform the broader market over the next year. [1, 5, 7, 8, 11, 12]

Latest News

CaixaBank Reports Strong H1 2025 Financial Performance and Announces Share Buyback

CaixaBank achieved record profits in 2024, reaching €5,787 million, a 20% increase from 2023, driven by intense commercial activity and high interest rates. The bank also reported strong financial performance in H1 2025, with net interest income growing by 9.8% year-on-year. Furthermore, CaixaBank announced a new share buyback program of up to €500 million, completing its 2022-2024 distribution plan, and will distribute a final dividend of 0.2864 euros gross per share in April. These developments are highly positive for the stock, indicating robust profitability, strong shareholder returns, and effective capital management. [12, 14]

RBC Capital Markets Adjusts CaixaBank Price Target Following Q2 Earnings

On August 1, 2025, RBC Capital Markets updated its price target for CaixaBank to 7.50 euros from 7.25 euros, reaffirming a 'sector perform' rating. This adjustment followed CaixaBank's better-than-expected loan and deposit growth in the second quarter, leading RBC to raise its net interest income projections for 2025 to 2027. This news suggests that while the bank's operational performance is improving, some analysts maintain a cautious but positive outlook on the stock's future valuation relative to its current price. [8]

CaixaBank Not Pursuing Acquisitions

CaixaBank's CEO stated on July 30, 2025, that the bank is not currently looking at undertaking any acquisitions. This news implies a focus on organic growth and optimizing existing operations, which can be viewed positively by investors who prefer a steady, less risky growth strategy over potentially dilutive or challenging M&A activities. [14]

Rumors

No recent rumors found.

Overview

Snapshot

Short-term Outlook

1-Year Outlook

The consensus among analysts for CaixaBank is 'Buy', with a 12-month price target ranging from 6.80 EUR to 9.50 EUR, averaging 8.2425 EUR. Despite the current price being above the average target, the significant outperformance over the last year, strong fundamental outlook, and commitment to shareholder returns (dividends and buybacks) position the stock for continued strength. The bank's solid market position in the Iberian Peninsula and its new strategic plan for 2025-2027 should support long-term growth. Considering the highest analyst estimate and the company's strong trajectory, the stock is likely to outperform the broader market over the next year. [1, 5, 7, 8, 11, 12]