Tip: start typing a company name to see suggestions. Press Enter or click Go to open its analysis page.

Market Performance Visuals

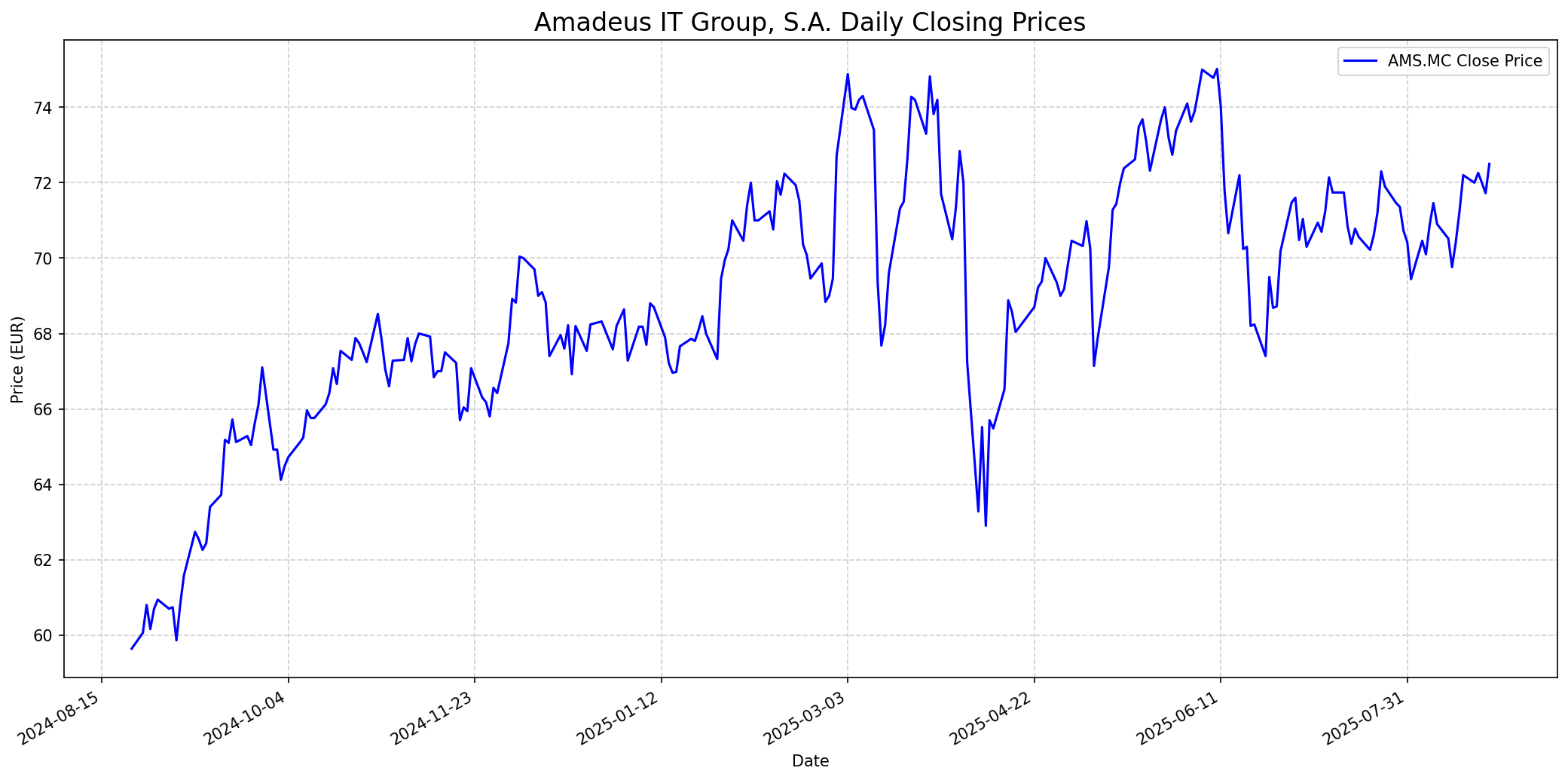

Stock Performance

Daily closing price of AMS.MC.

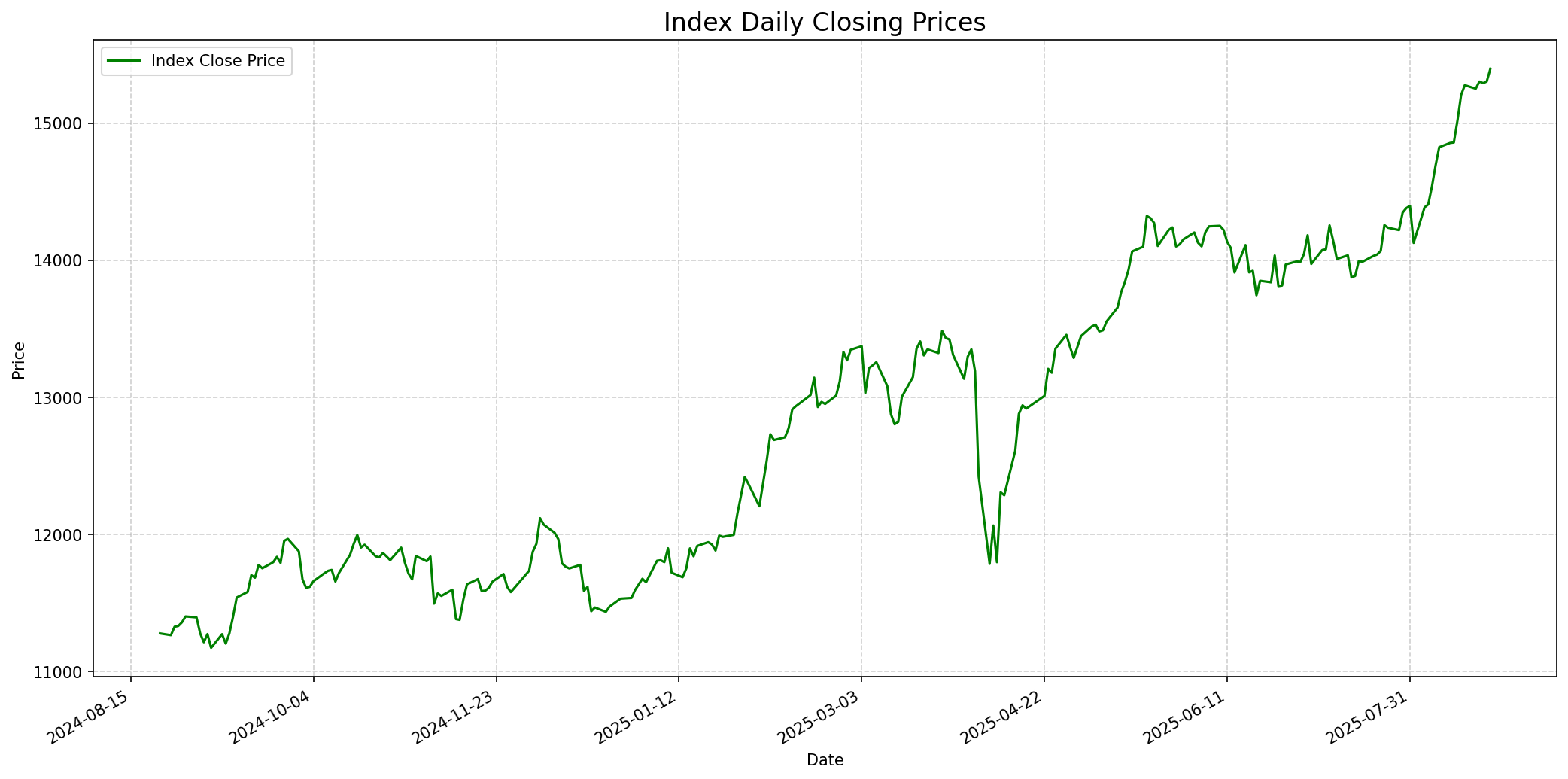

Relevant Index Performance

Performance of the relevant market index.

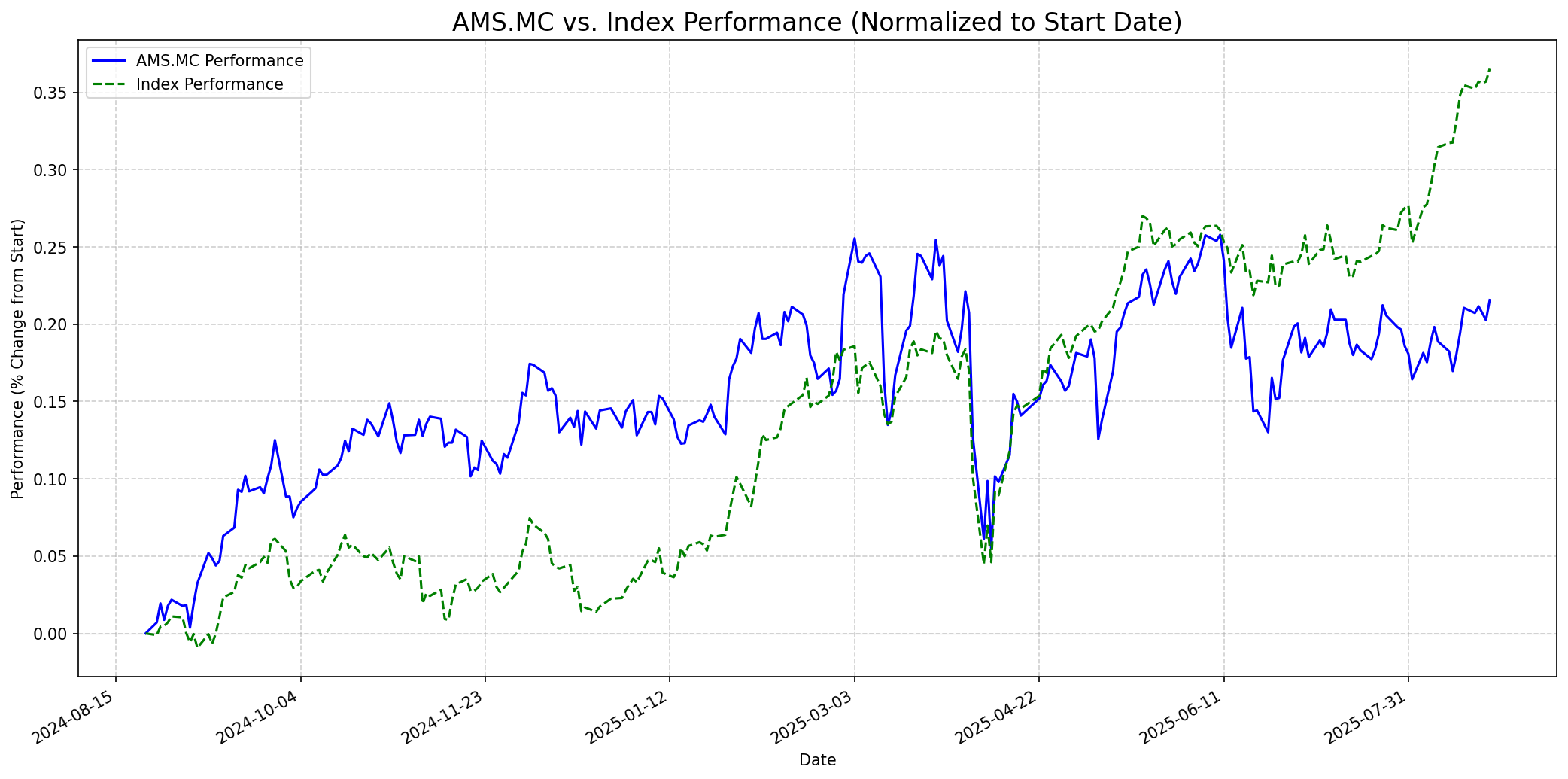

Stock Relative to Index

AMS.MC's performance compared to its index.

Social Media Sentiment

Reddit: Neutral

Discussions on Reddit regarding Amadeus IT Group, S.A. (AMS.MC) are scarce. While general discussions about travel industry stocks occasionally mention Amadeus in the context of global distribution systems, there is no recent or significant dedicated discussion about AMS.MC's stock performance or future outlook. [14] Mentions of 'Amadeus' on Reddit are often unrelated, such as discussions about a recruitment company or academic surveys. [19, 20] Therefore, the overall sentiment on Reddit for AMS.MC is currently neutral due to a lack of specific, pertinent chatter.

Twitter/X: Neutral to Slightly Bullish

Twitter sentiment for AMS.MC is inferred to be neutral to slightly bullish. While no specific trending hashtags or key influencers for AMS.MC were found, the stock has shown recent upward movement in price. [8] The general consensus from analysts also leans towards a 'Buy' or 'Moderate Buy' rating with positive price targets. [1, 7, 10] This suggests a cautiously optimistic outlook among market observers on Twitter, aligning with broader market trends in the travel technology sector.

Fundamentals

Amadeus IT Group, S.A. (AMS.MC) is a leading provider of information technology (IT) services primarily for the tourism and travel industries, holding the largest market share (over 40%) among the top three Global Distribution System (GDS) operators. [11, 12, 14] The company's activities are divided into its Distribution division, offering a worldwide computerized reservation system for booking various travel services, and its expanding IT Solutions division, providing technology solutions for airlines, airports, rail, hotels, and travel agencies. [8, 11] Fundamentally, Amadeus reported a P/E ratio of 24.06 and an EPS of 2.97. [2] The fair value of AMS.MC is estimated at 73.83 EUR as of August 21, 2025, suggesting a potential gain of 2.54% from its current market price of 72.00 EUR. [5] The company saw low-teens sales growth in 2024, with demand expected to rebound in 2025 despite waning consumer sentiment and enduring inflation expectations. [11] Analysts forecast revenue for this year to reach 6.7 billion EUR, an 8.4% increase from 6.1 billion EUR, and further growth to 7.2 billion EUR next year. [1] EPS is projected to be 3.3, a 17.4% increase, growing to 3.7 next year. [1] While the company's long-term leadership in GDS is expected to endure, potential negative impacts on corporate travel from increased video conferencing are noted as a bear factor. [11]

Performance Analysis (Last Year)

Performance: Underperformed

Over the last 365 days, Amadeus IT Group, S.A. (AMS.MC) underperformed its benchmark index. The stock's closing price increased from approximately 59.64 EUR to 72.50 EUR, representing a gain of about 21.57%. In contrast, the index's closing price rose from approximately 11278.10 to 15396.80, a gain of about 36.52%. This indicates that while AMS.MC showed positive growth, it did not keep pace with the broader market's rally. The underperformance can be attributed to several factors including 'waning consumer sentiment and enduring inflation expectations' that were noted when entering 2025. [11] Despite Amadeus seeing 'low-teens sales growth in 2024' and expecting demand to rebound, these macroeconomic headwinds likely tempered investor enthusiasm compared to the overall market. [11] Additionally, the stock's technical analysis suggests it has been a 'medium performer' in the overall market, outperforming only 60% of all stocks, further supporting the underperformance against the index. [3]

Future Outlook

One Week

Price Target: $72.8

Performance vs Index: In-line

In the short term (one week), AMS.MC is expected to perform in-line with the broader market. The stock has shown recent positive price movements, with its price rising above the 15-day moving average on August 19, 2025. [8] Technical analysis also indicates that the short-term trend for AMS.MC is up, and its current price is above the rising SMA(20). [3] Given this positive momentum and no immediate negative catalysts, a slight upward movement is anticipated, keeping it generally in line with a stable or slightly rising market.

One Month

Price Target: $73.5

Performance vs Index: Outperform

Over the one-month horizon, AMS.MC is anticipated to modestly outperform its index. The average analyst consensus for AMS.MC is a 'Buy' or 'Moderate Buy' with an average 12-month price target significantly above its current trading price, indicating underlying confidence. [1, 7, 10] The news of Riyadh Air joining Amadeus's travel platform in early August provides a positive catalyst for continued growth. [16] While technical analysis notes some doubts in the medium timeframe, recent action has been very positive, with both long and short-term trends being positive. [3] This, combined with an expected rebound in demand for Amadeus's services in 2025, suggests potential for outperformance in the near to medium term. [11]

One Year

Price Target: $78.5

Performance vs Index: Outperform

The one-year outlook for AMS.MC is positive, with an expectation to outperform the index. The consensus recommendation from 28 analysts is 'Buy', with an average price target ranging from 77.91 EUR to 78.71 EUR, representing a notable upside from the current price. [1, 10, 16] Amadeus's strong market position as the largest global distribution system operator, coupled with its expanding IT solutions division, provides a solid foundation for long-term growth. [11, 12] The company is strategically positioned to benefit from the continued recovery of the travel industry, despite some economic uncertainties. [11] Ongoing investments in technology and expanding client relationships, like the recent deal with Riyadh Air, are expected to drive revenue and EPS growth in the coming year. [1, 16]

Latest News

Riyadh Air to Join Amadeus IT Group's Travel Platform

On August 7th, Riyadh Air announced its partnership with Amadeus IT Group's travel platform, indicating new business for Amadeus in the airline sector. This development is likely to be positive for the stock as it expands Amadeus's client base and strengthens its position in the travel technology market. [16]

Amadeus IT Group, S.A. acquired Forward Data S.L.

Amadeus IT Group, S.A. recently acquired Forward Data S.L. While the specific impact of this acquisition isn't fully detailed in the provided snippets, strategic acquisitions generally aim to enhance capabilities, expand market reach, or integrate new technologies, which could be beneficial for Amadeus's long-term growth. [6]

Amadeus IT Group, S.A.'s Equity Buyback suspended

Amadeus IT Group, S.A.'s equity buyback program, announced on June 13, 2023, has been suspended. The suspension of a buyback program can sometimes be interpreted negatively by the market, as it may suggest a shift in capital allocation priorities or concerns about future cash flow, though further details would be needed for a complete assessment. [6]

Rumors

No recent rumors found.

Overview

Snapshot

Short-term Outlook

1-Year Outlook

The one-year outlook for AMS.MC is positive, with an expectation to outperform the index. The consensus recommendation from 28 analysts is 'Buy', with an average price target ranging from 77.91 EUR to 78.71 EUR, representing a notable upside from the current price. [1, 10, 16] Amadeus's strong market position as the largest global distribution system operator, coupled with its expanding IT solutions division, provides a solid foundation for long-term growth. [11, 12] The company is strategically positioned to benefit from the continued recovery of the travel industry, despite some economic uncertainties. [11] Ongoing investments in technology and expanding client relationships, like the recent deal with Riyadh Air, are expected to drive revenue and EPS growth in the coming year. [1, 16]