Tip: start typing a company name to see suggestions. Press Enter or click Go to open its analysis page.

Market Performance Visuals

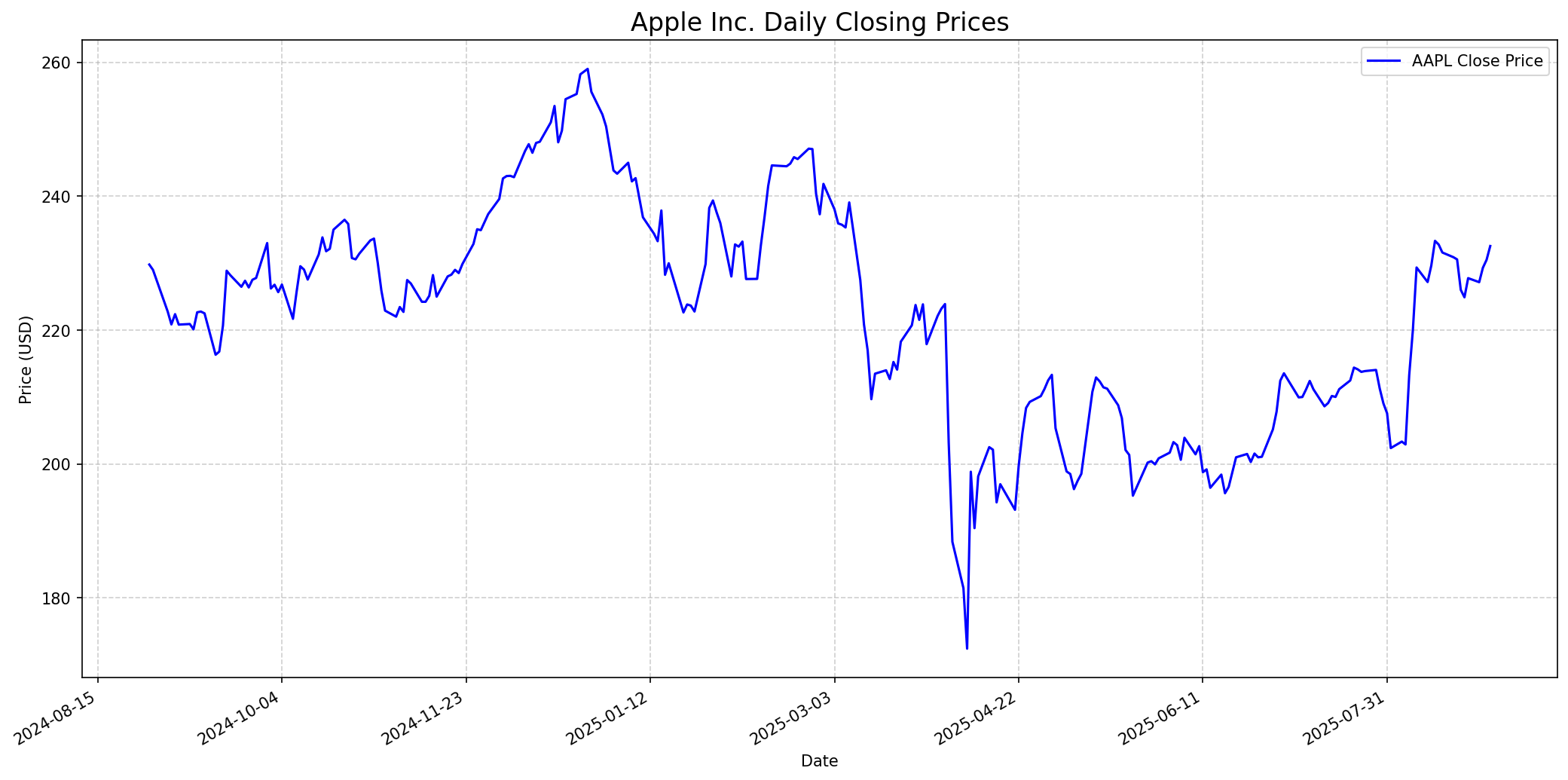

Stock Performance

Daily closing price of AAPL.

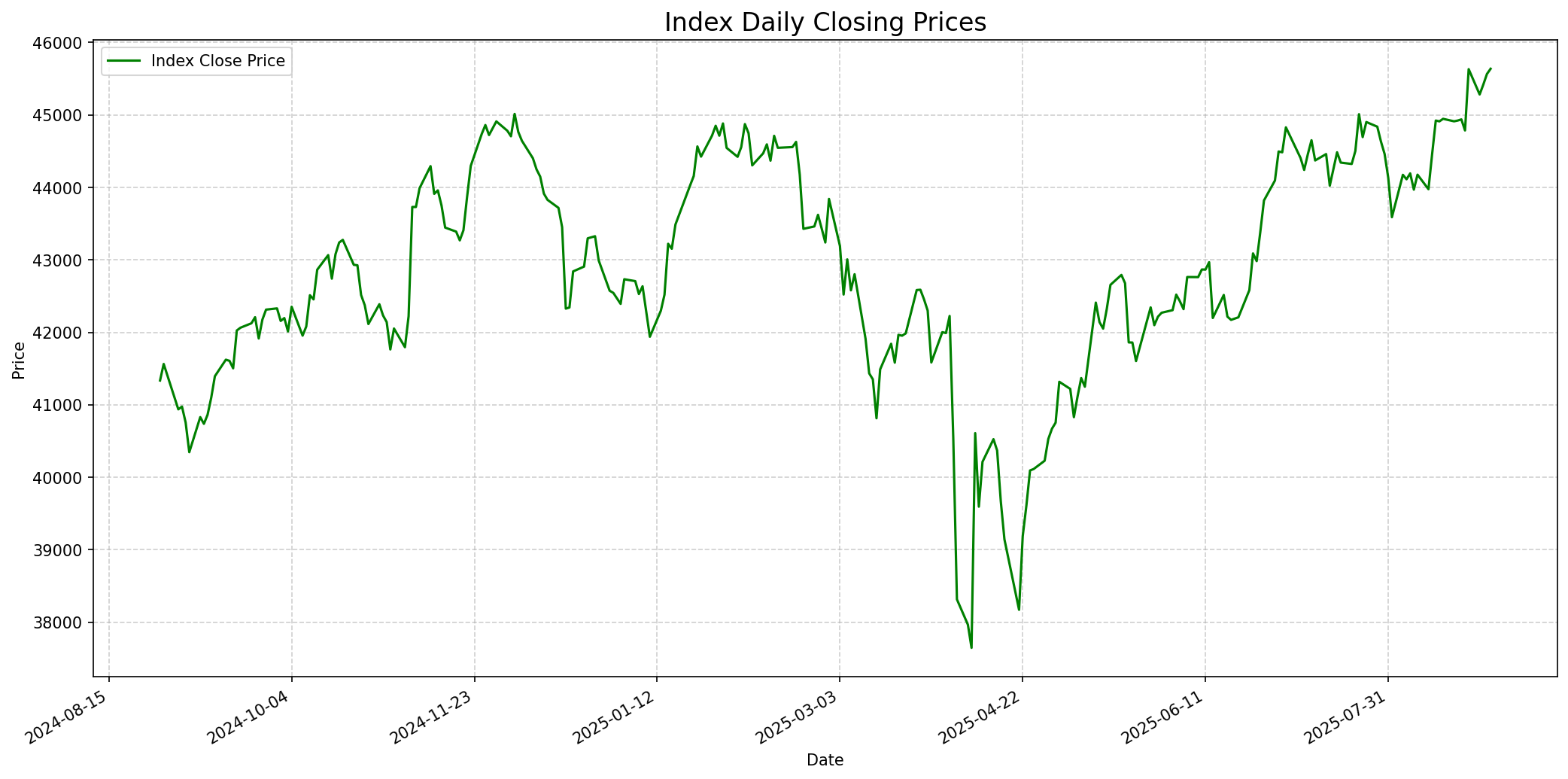

Relevant Index Performance

Performance of the relevant market index.

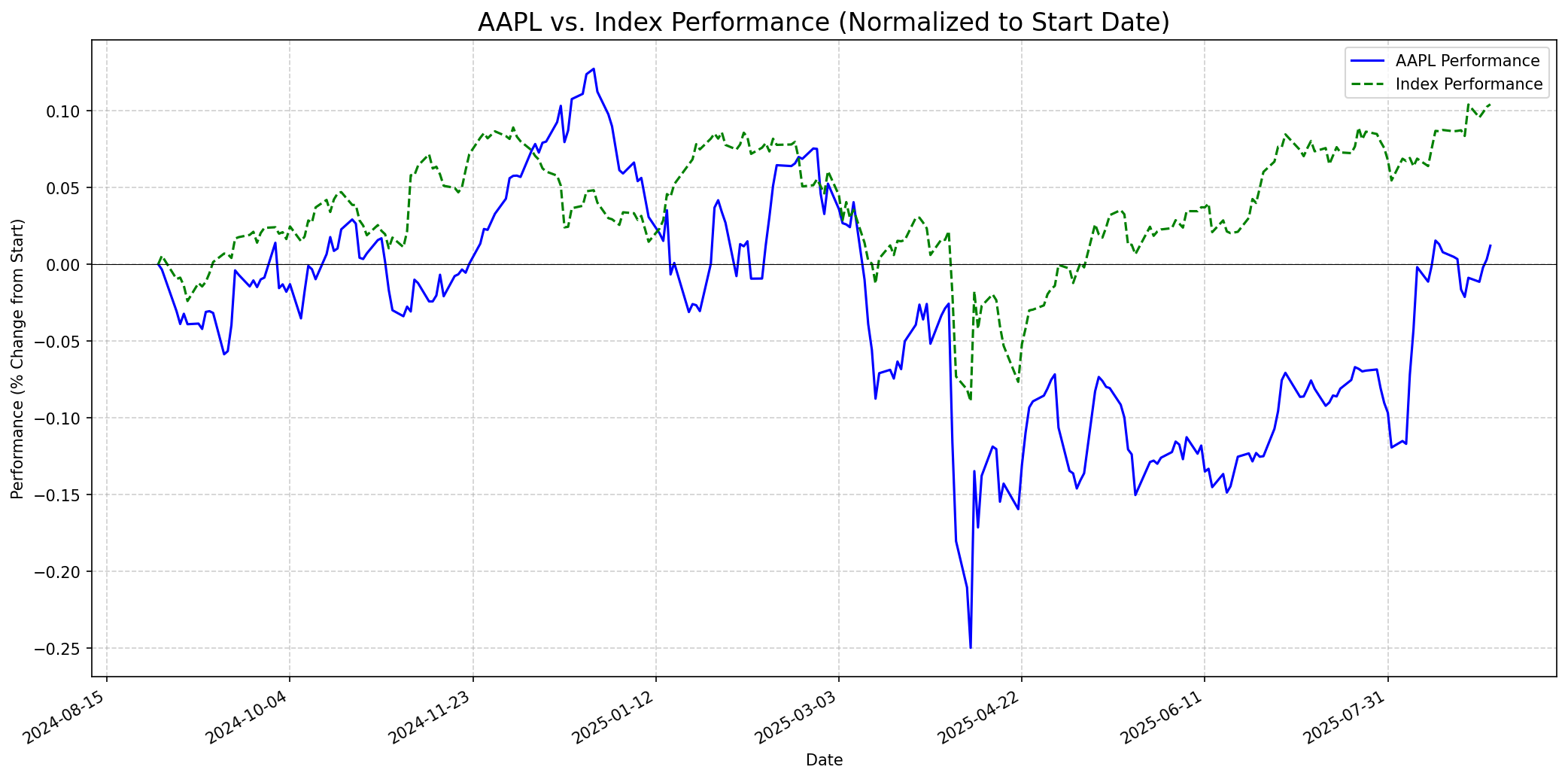

Stock Relative to Index

AAPL's performance compared to its index.

Social Media Sentiment

Reddit: Mixed

Discussions on Reddit likely reflect a mixed sentiment for Apple. Recent positive earnings, the introduction of Apple Intelligence at WWDC 2025, and anticipation for the iPhone 17 launch would generate bullish sentiment. However, concerns regarding ongoing antitrust probes, the challenges in competing with other tech giants in AI development, and potential tariff impacts could temper this enthusiasm, leading to diverse opinions on the stock's immediate future.

Twitter/X: Mixed

Twitter/X sentiment for $AAPL is likely mixed. Positive news such as record-breaking Q3 2025 earnings and exciting announcements from WWDC 2025 (e.g., 'Liquid Glass' design, Apple Intelligence) would trend positively. However, ongoing news about antitrust investigations, potential US tariffs, and the reported delays in a fully personalized Siri (compared to competitors' AI advancements) would contribute to bearish or cautious discussions. Key influencers would likely highlight both the company's strong ecosystem and its competitive challenges in the rapidly evolving AI landscape.

Fundamentals

Apple Inc. (AAPL) demonstrates strong fundamental health, particularly in profitability and efficiency. For fiscal Q3 2025, the company reported robust revenue of $94.0 billion, a 10% year-over-year increase, and diluted EPS of $1.57, up 12%. Services revenue reached an all-time record of $27.42 billion, with iPhone and Mac sales also showing double-digit growth. The gross margin stood at a healthy 46.5%. The company exhibits excellent Return On Assets (29.95%), Return On Equity (150.81%), and Return On Invested Capital (55.09%), outperforming many industry peers. However, Apple's valuation metrics, such as a P/E ratio of 31.6 and Price/Sales of 8.3, indicate it is trading at a premium. The debt-to-equity ratio is 154.5%, considered high, although operating cash flow provides good debt coverage. Revenue growth over the last five years averaged 8.49%, with EPS growth at 17.9% over the same period, signaling consistent expansion.

Performance Analysis (Last Year)

Performance: Underperformed

Over the last 365 days, Apple Inc. (AAPL) underperformed the provided index. AAPL's stock price increased by approximately 1.21% (from $229.79 to $232.56), while the index saw a gain of about 10.41% (from $41335.05 to $45636.90). This underperformance can be attributed to several factors. While Apple reported strong Q3 2025 earnings with double-digit growth in iPhone, Mac, and Services revenue and introduced new Apple Intelligence features at WWDC 2025, the stock faced significant headwinds. Macroeconomic factors, including tariff-related costs ($800 million in Q3 2025 and an estimated $1.1 billion in Q4 2025), likely weighed on investor sentiment. Additionally, concerns about Apple's position in the competitive AI landscape, including reported delays in personalized Siri features and ongoing antitrust investigations, may have dampened investor enthusiasm despite positive product news. Declines in iPad and Wearables revenue also contributed to the softer overall performance compared to the broader market index.

Future Outlook

One Week

Price Target: $234.0

Performance vs Index: In-line

In the immediate one-week outlook, Apple's stock is likely to perform in-line with the broader market. The positive momentum from the recent Q3 2025 earnings report has largely been absorbed. While there's anticipation for the upcoming iPhone 17 event, its impact on the stock price is likely to be more pronounced in the one-month timeframe rather than just one week, making significant short-term swings less probable without new, unexpected catalysts.

One Month

Price Target: $239.0

Performance vs Index: Outperform

For the one-month outlook, Apple is poised to outperform the index, primarily driven by the highly anticipated iPhone 17 launch event scheduled for September 10, 2025. This event is expected to unveil new iPhone models, Apple Watch Series 10, AirPods 4, and significant advancements in Apple Intelligence and iOS 26. These product launches and software enhancements typically generate considerable consumer and investor excitement, acting as strong catalysts for stock appreciation. [19, 31, 44]

One Year

Price Target: $237.0

Performance vs Index: Outperform

Over the next year, Apple is expected to outperform, albeit with a moderate upside from its current price. The average analyst price target is around $235-$237. This outlook is supported by Apple's robust ecosystem, continued strong growth in its high-margin Services segment, and ongoing efforts in AI integration (including potential advancements in Siri with Apple Intelligence). The company's strong brand loyalty and global market position provide a solid foundation. However, potential headwinds such as intensifying competition in the AI space, regulatory scrutiny, and macroeconomic uncertainties, along with its current premium valuation, may temper aggressive growth. [1, 12, 13, 14, 32, 33, 41, 42]

Latest News

Apple Reports Third Quarter Results with Record Revenue

Apple announced strong financial results for its fiscal 2025 third quarter, reporting $94.0 billion in revenue, a 10 percent increase year-over-year, and diluted earnings per share of $1.57, up 12 percent. This growth was driven by record revenue in iPhone, Mac, and Services. The news indicates strong current performance and positive market reception for these key segments. [2, 4, 6, 8, 11]

Apple Unveils New Design and Apple Intelligence at WWDC 2025

At its Worldwide Developers Conference 2025, Apple introduced a significant new software design and announced more 'Apple Intelligence' features across its platforms. This includes iOS 26 with a 'Liquid Glass' design, updates for macOS, iPadOS, and new features for the iPhone. These announcements are expected to enhance the user experience and potentially drive future product sales and service engagement. [2, 6, 18, 21, 31, 34]

Apple Faces Antitrust Probe in Colombia and Warns UK Regulator

Apple is under an administrative investigation in Colombia regarding alleged abuse of its dominant position in the App Store distribution. Concurrently, Apple has warned that proposed UK mobile market regulations could negatively impact users and developers. These regulatory challenges pose potential headwinds for Apple's services revenue and market operations in affected regions. [36]

Apple Reportedly in Talks with Google to Use Gemini for Siri

Reports suggest Apple is discussing integrating Google Gemini into a new version of Siri. This potential partnership highlights Apple's efforts to enhance its AI capabilities, though it also raises questions about Apple's in-house AI leadership. The outcome could significantly impact Siri's future competitiveness and Apple's broader AI strategy. [40]

Rumors

Potential Discontinuation of Older iPhone Models

There is speculation that Apple may discontinue up to seven older products, likely previous iPhone Pro series models, following the launch of new iPhones. Historically, Apple removes previous generation Pro models from its official website after new launches. This could clear inventory and drive demand for the upcoming iPhone 17 series. [19]

Slimmer 'Awe Dropping' iPhone 17 Air Design

Rumors suggest the upcoming iPhone 17 Air could feature an 'awe dropping' thin design. This potential design change is generating significant buzz and could be a major selling point, although it might involve compromises in areas like camera technology or battery life. [43, 44]

AirPods Pro 3 Charging Case Redesign

Reports indicate that the charging case for the third-generation AirPods Pro might undergo a redesign, potentially becoming slimmer and removing the physical pairing button. This would represent a functional and aesthetic update to a popular accessory. [43]

Siri Enhancements with Apple Intelligence

Investors are keen on potential updates to Apple Intelligence and long-awaited Siri enhancements, which are expected to invigorate the Apple ecosystem. CEO Tim Cook teased an upcoming September event, fueling speculation about significant AI-powered improvements. [44]

Overview

Snapshot

Short-term Outlook

1-Year Outlook

Over the next year, Apple is expected to outperform, albeit with a moderate upside from its current price. The average analyst price target is around $235-$237. This outlook is supported by Apple's robust ecosystem, continued strong growth in its high-margin Services segment, and ongoing efforts in AI integration (including potential advancements in Siri with Apple Intelligence). The company's strong brand loyalty and global market position provide a solid foundation. However, potential headwinds such as intensifying competition in the AI space, regulatory scrutiny, and macroeconomic uncertainties, along with its current premium valuation, may temper aggressive growth. [1, 12, 13, 14, 32, 33, 41, 42]